PM Gillards anouncement yesterday of a breakthrough and a Victory, paved the way for individual industry sectors to have varying tax rates.It renamed the RSPT to a minerals tax. It was clever. It was quick, and it left many smaller miners out in the cold. It also opened the way to target silver, gold mining and everything else.

In an effort to be fair, I have listed both for and against viewpoints below.

Of course what has not been discussed is the Joint ventures by Aboriginal communities with overseas companies who are not even listed on our ASX, which means Aussie shareholders cannot invest and benefit from these Joint Ventures. Nor does it mention Chinese/Indian ownership in full where takeovers have been made and the company has then delisted from the ASX. What amount of tax will these groups pay?

There will be a constitutional challenge, and the coming election will be fought on tax.The legislation for this tax willnot be presented to the senate until end 2011. so who willhold the balance of power in the senate? The greens want the tax, and will vote with Labor. The liberals are voting against it. It will all depend on who gets elected in the coming election tobe held before the end of the year. November is my latest guess, because Gillard wants to get some more victories under her belt before she goes to the polls.

The Government’s Standpoint

Current royalties and taxes fail to collect appropriate returns from private (what about foreign) companies extracting non-renewable resources that belong to the Australian people

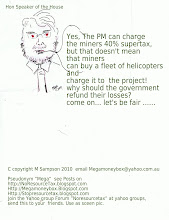

The mining industry asked that any additional taxation needed to be applied to profits rather than the resource/minerals so they only paid extra tax when they were making money – (above a bond rate of 6% or now new up-lift of 12% GROSS PROFIT) this tax does just that.

The RSPT provides a more efficient mechanism for collecting a share of the returns to the community. (the non mining industry groups wanted a reduced company tax on Net profits to be 25%, now 29% which would help them pay more superannuation of 12%- for their employees)

The RSPT will encourage greater investment and employment in the resources sector.

The government has produced a Fact Sheet that fully outlines their rationale. You can get your copy here:

Resource Super Tax Fact Sheet

The Mining Industry Standpoint

The mining industry is more than happy to pay its fair share of taxes

The mining industry already pays its fair share of tax – $80 billion in the last decade

Mining companies pay corporate taxes just like every other corporation, plus they pay royalties; these taxes and royalties already give an effective tax rate of over 40%

The RSPT would raise the total effective rate to 58%,(2.07.10 the NEW minerals tax would now raise it to 42%) making it the highest tax rate in the world

Our biggest competitors, Canada and Brazil have tax rates of 23% and 27-38% respectively

Mining in Australia needs to be taxed at an internationally competitive rate

Current mining operations should not be taxed retrospectively (because the projects could have been started years ago) as these investments were made on the assumption of current tax rates.

Further details of the mining industry standpoint can be viewed at the Keeping Mining Strong website.

skip to main |

skip to sidebar

Julia's portrait for the PM Hall

Where in the B..Hell are you Johnny?

Twitter

We have to link together like an internet cobweb. The More spiders the better

What you can do besides writing to editors, politicians, and speaking up, is to become followers on as many blogs and forums and twitter sites which oppose the Resource Super profit Tax, as possible. If you forward information on the tax to as many people as possible, you will raise awareness. This tax is unconstitutional, and PRRT contains secrecy clauses, which means if you were a "whistleblower" you could be liable for $10,000 fine and or 2 years jail. Worse still, you could not present any documents relating to that company to the court.

When you become a follower, you help raise the status of the campaign. You can Email our cartoons, or pics. use them as screensavers and as an opportunity to raise the Supertax issue. Respect our efforts by adding our links, and giving credit for our volunteered work.

When you become a follower, you help raise the status of the campaign. You can Email our cartoons, or pics. use them as screensavers and as an opportunity to raise the Supertax issue. Respect our efforts by adding our links, and giving credit for our volunteered work.

Julia PM -barring all

Julia's portrait for the PM Hall

Welcome! to my Election Blog

This blog is written and authorised by NSW senate candidate Megan Sampson Wollongong (silent elector address)

My main election blog is at Http://megansampson.blogspot.com

you can email me at msmegansampson at gmail dot com

Get to know more..

see my other blogs at

Http://msmegansampson.blogspot.com

http://megamoneybox.blogspot.com

http://reduceyouruse.blogspot.com

http://cutcarbonuse.blogspot.com

http://www.permculturevisions.com

My main election blog is at Http://megansampson.blogspot.com

you can email me at msmegansampson at gmail dot com

Get to know more..

see my other blogs at

Http://msmegansampson.blogspot.com

http://megamoneybox.blogspot.com

http://reduceyouruse.blogspot.com

http://cutcarbonuse.blogspot.com

http://www.permculturevisions.com

Vote for Megan Sampson in NSW senate.Col K.

Make your own solar panels!

All the grannies want Little Johnny Howard back

Where in the B..Hell are you Johnny?