Saturday, May 29, 2010

RIO's chairmam hands QUICK FIX to RUDD

ref http://www.abc.net.au/insidebusiness/

He gave Rudd the good excuse to legislate ASAP

because this uncertaintly about the tax is damaging Australia's reputation as a stable, predictable country.

NOW CONSIDER THIS...

when they frame the legislation (whatever that is and how many changes - is anybody's guess.)and get it passed, it then has to go through the Senate.

so its a numbers game..

The numbers right now are ALP 32, and probably the greens 5 =37

LIBS ie 32 plus NATS 4 and CLP 1 = 37

The two who hold the balance of power are Independent 1 = (Nick Xenophon) and Family first 1 (Fielding)

SO how will the vote pan out??

it doesn't matter how many press releases and newspaper/tv ads are placed, the public dont understand the concept, and have closed their ears anyway.

THE ONLY THING THAT MATTERS IS THE VOTE!

IF THE LEGISLATION is not voted on until after the election, the outcome is anyones guess.New Parties will emerge and independents will stand to support both parties with their second preferencs.

They will target marginal seats and some will stand for the senate.

The senate is where the legislation stands or falls.

"We live in interesting times."

Friday, May 28, 2010

Do you think Rudd will do a backflip- sorry , but i don't

THE Rudd government is moving towards a major backdown on its $12 billion tax on resources, redefining its proposed super-profits levy, but the big mining companies have declared the changes do not stop the risk to investment in Australia.

Only three weeks after unveiling the new resource super-profits tax, the government is preparing to lift the threshold definition of a super profit from 6 per cent to 11 or 12 per cent following a ferocious campaign by the mining companies.

To offset the lost revenue in raising the threshold to the same level as the existing petroleum resources rent tax, which applies to offshore gasfields, the government intends to withdraw the 40 per cent taxpayer-funded compensation originally offered for mining projects that fail.

But all the major mining companies have rejected the new proposals as "tinkering at the edges" and not addressing the main risk to mining investment in Australia. The mining companies are demanding more negotiation with the government on the issues of the retrospective application of the new tax, different rates for different minerals and the 40 per cent tax rate.

Start of sidebar. Skip to end of sidebar.

Related Coverage

DU PLESSIS: Rio boss returns fire at Swan

OFFICIAL: Outcry only scaring investors

RICH LIST: Mining magnates dig in

DENNIS SHANAHAN: Judges give Rudd a big zero

DESPATCH BOX: And then Papa Bear said...

VIDEO: Resources tax minefield

IN DEPTH: Henry Tax Review

Mining tax won't raise prices - Henry Daily Telegraph, 11 hours ago

$27bn ore exports at risk The Australian, 20 hours ago

Treasury boss defends mine tax Herald Sun, 1 day ago

Good policy the winner as Labor rethinks its tax The Australian, 1 day ago

Miners paid extra in boom time Perth Now, 2 days ago

End of sidebar. Return to start of sidebar.

BHP Billiton chief executive Marius Kloppers declared last night that any thought the petroleum tax would work for minerals was "naive" and demonstrated "a lack of knowledge as to how investments are made".

"Most importantly, we must understand that for each mineral we are competing against other investment destinations, and each set of minerals has a different set of competitors and those competitors set the price," Mr Kloppers told The Australian.

And Xstrata chief executive Mick Davis said from South Africa: "The government needs to do what it should have done all along and enter into full and open consultations with the industry where every aspect of the super tax is open for debate. Tinkering at the margins will not avoid the significant long-term damage this tax could do to mining investment in Australia.

"The government should stop negotiating with itself and start consulting with the industry."

Rio Tinto chairman Jan du Plessis told the company's shareholders that Australia's reputation had already been damaged by the super-profits tax proposal.

"We are concerned that the proposed resources super tax will erode Australia's competitiveness, severely curtail investment and limit jobs growth," Mr du Plessis said yesterday. He said that some of the government's arguments for the tax and some of the statistics that had been produced to support them "could only be described as scandalous, totally scandalous".

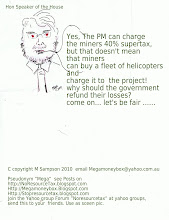

Wayne Swan continued his criticisms of the mining companies yesterday, telling parliament they were still paying only 17c in the dollar in tax compared with the "headline rate" of 30 per cent. The Treasurer vowed to keep the 40 per cent rate for the new RSPT.

"What we have to do is extract the maximum value for the Australian people as we go forward to reform our economy, to invest in our economy and to ensure our prosperity as we go forward," Mr Swan said.

Earlier, he said the government was "interested and fair dinkum about consultation".

"The government is involved in consultation," Mr Swan said. "First of all, we have our consultation panel. Over 80 companies have been through that panel process and are talking to that panel. In addition to that, the government is continuing to talk to many mining companies about their views.

"What we are going to get for the Australian people is a fair share of the resources they own 100 per cent, a fair share - a tax which encourages investment and growth in the industry."

The government's consultation panel, headed by Treasury deputy secretary David Parker, will give its first report to the government tomorrow. It is expected to go beyond its strict limits for discussion and recommend the raising of the threshold for the super-profits tax to be lifted from 6 per cent, the long-term government bond rate, to about 11 or 12 per cent, the bond rate plus five or six percentage points.

As reported in The Australian on Monday, the lost revenue would be covered by the withdrawal of the 40 per cent compensation for failed projects to enable the government to keep its budget projections, including a $1bn surplus in 2012-13, intact.

Mr Parker said yesterday the proposed RSPT as a result of the Henry tax review was "the architecture of reform, not the engineering drawings".

"With such reforms, there will always be winners and losers, with some groups more vocal than others," Mr Parker said. "The challenge is to work together to address the issues that will inevitably arise."

Government sources confirmed that the panel was expected to recommend major changes to the proposed RSPT, including raising the threshold, but others warned it was unlikely there would be an early settlement of the negotiations with the mining companies.

In Adelaide, Mr Kloppers said a 40 per cent tax rate may have been considered appropriate when it was devised for the petroleum industry in the 1980s after two years of consultation but it was "a giant, naive extrapolation to think miraculously the same one is the appropriate rate for every mineral in 2010".

"BHP Billiton, being in the oil and gas industry and in the minerals industry, has experience on both sides and, more than other players, we understand the difference between the products themselves and between minerals more broadly," he said.

"Retrospectivity on this tax is the key determinant for Australia as a destination for investment.

"It goes against the core offering that Australia has, which is being a stable place for investment."

Thursday, May 27, 2010

Join the Noresourcetax yahoo forum

Politics is a numbers game, and unless this blog and the forum have a large number of followers, then the opinions expressed on behalf of the mining industry, will be ignored.

You can help by sending us your email contact addresses to Megamoneybox@yahoo.com.au

or forwarding this email to your all friends.

This campaign will need to continue for at leaast 3 months.

If we all try, we can help to have the 40% resource tax defeated, at worst, we can try to change the way it will be introduced, to at least a tax on the net profit.

Fw: change or no change?

> SYDNEY, May 27 (Reuters) - Australia's government may be considering

> changes to its controversial new mining tax, which critics argue will hit

> economic growth and supporters say will ensure miners pay a fair price for

> limited national resources.

>

> Treasurer Wayne Swan, after weeks of public and private debate, has so far

> said he will proceed with the original "tax framework" to take effect in

> 2012, but details of the tax are subject to negotiation and could be

> tweaked.

>

> * WHAT'S CHANGED SINCE THE MAY UNVEILING OF THE TAX?

>

> Prime Minister Kevin Rudd has said the 40 percent tax rate is set in stone

> and will not give ground here for fear of damaging his authority in the

> lead-up to elections later this year. But The Australian and The Sydney

> Morning Herald newspapers reported on Thursday that Rudd's Labor party is

> moving to soften the blow by redefining a windfall or "super" profit to

> returns on assets exceeding 12 percent, up from 5.3 percent now.

> [ID:nSGE64P0M8]

>

> The 5.3 percent threshold-- linked to the the 10-year government bond

> yield AU10YT=RR -- is a key gripe among the miners, who think it is

> unrealistically low.

>

> A Treasury-sanctioned tax consultation panel is due to deliver its first

> report to the government on Friday after meeting over the last week with

> mining companies. The panel's report is expected to focus on the

> definition of a super profit.

>

> The tax is not due to be introduced until 2012, after the next general

> election, so there is even a chance the government will be voted out

> before it can implement it. [ID:nSGE64J02A]

>

> WHAT ARE THE POSSIBLE POINTS OF COMPROMISE?

>

> The least likely point of compromise seems to be the headline rate of 40

> percent. But even here, Rudd has some wiggle room, describing the headline

> rate as "about right".

>

> Beyond that, there are aspects of the complex tax which, if changed, could

> dramatically lower its impact.

>

> * EXISTING VS FUTURE PROJECTS: Australia's two largest miners, Rio Tinto

> RIO.AX <RIO.L and BHP Billiton (BHP.AX) (BLT.L), have called on the

> government to exclude existing mining operations and apply the tax only to

> projects beginning after 2012. The government says such exclusions would

> forfeit too much revenue and discourage miners from expanding.

>

> Miners can still look to offsetting tax credits for exploration and

> development costs, resulting in a lower effective tax rate than 40

> percent. But what about all the hundreds of billions of dollars already

> sunk into existing projects? Will the government award retrospective tax

> credits for these?

>

> The architect of the tax, Treasury chief Ken Henry, has argued against

> this. But miners have support from some economists who suggest a credit

> for 40 percent of original investments. However, a group of 20 prominent

> academic and business economists has publicly backed the tax, saying the

> sector should fork over more of its profits. The group, including the

> former chairman of the Australian Competition and Consumer Commission,

> Allan Fels, issued a statement supporting the tax.

>

> * FINANCING COSTS: Iron ore miner Fortescue Metals Group Chief Executive

> Andrew Forrest (FMG.AX) says unlike company tax, the new mining tax will

> hit firms higher up the profit statement, before deducting interest on

> borrowings. This means banks will not fund new projects unless businesses

> stump up more equity.

>

> Playing the nationalist card, Forrest says this opens the door to

> deep-pocketed foreign firms, especially state-owned Chinese ones, to buy

> up stakes in new Australian projects. A compromise could involve financing

> costs being excluded from calculations.

>

> * WILL THE GOVERNMENT BACK DOWN ON THE TAX?

>

> Rudd will not reverse course on the tax, despite conservative opposition

> threats to overturn it if they secure an unexpected victory. But with

> Rudd's support in opinion polls slipping dangerously and the tax causing

> unease among voters, fuelled in part by a multi-million-dollar advertising

> campaign by miners, a compromise to cool the issue politically seems

> certain.

>

> It is a matter of finding a face-saving solution for Rudd that keeps the

> resource giants on side.

>

> Even if negotiations break down, there is one last hope for the miners: a

> legal challenge. The largest mining state, Western Australia, is

> consulting its lawyers over whether the tax exceeds Canberra's powers

> under the national constitution, which forbids the centre from taxing the

> property of state governments. Two constitutional experts cast doubt,

> however, on whether there would be grounds for a legal challenge.

> [ID:nSYU009974] (Additional reporting by Rob Taylor in CANBERRA; Editing

> by Ed Davies)

>

>

>

Wednesday, May 26, 2010

FMG Battles the proposed super profit tax

PERTH (miningweekly.com) - ASX-listed Fortescue Metals on Tuesday reiterated

its call on the Federal government to scrap the proposed super profits tax

(SPT), saying that the tax would harm the mining industry.

"It harms the mining industry and especially Fortescue, and we are urging

the government to drop this proposal and to open a new forum for dialogue

with all industries to discuss tax reform," Fortescue chairperson Herb

Elliott said.

In an open letter to shareholders, Elliott also called on shareholders to

raise their voices against the proposed SPT.

"Please tell them how flawed this tax is and how it will continue to harm

the Australian economy. Demand that they remove this deeply troubling impost

on Australia's position as a globally respected destination for investment,

and on Australia's ability to create jobs, to keep its people employed, and

its overall economic strength," he added.

Elliott added that while Fortescue acknowledged that Australia needed a tax

reform, the company was "bewildered" by the government's inability to

consult on this "poorly thought out" proposal.

"They introduced the tax with no consultation before they took it into their

budget and no real consultation since."

But he added that while Fortescue was pleased to be working with the

Treasury consultation panel to consider and make an input into a new and

fairer tax system, the consultative process did not allow for any

negotiations or discussions on the key parameters of the government's

proposal.

Elliot added that the panel had its "hands tied" behind its back by the

government, before consultation had started.

"Hence, previously healthy projects become unfinanceable. We now have a huge

new tax on the mining industry that will ultimately decimate future

investments in new projects and have a negative impact on the value of your

investment in our company," Elliott told shareholders.

The iron-ore miner has recently placed $15-billion worth of expansion

projects in the Pilbara region on hold as a direct result of the SPT.

Elliott said on Tuesday that the affected projects, the Solomon and Western

Hub projects, were of "national significance" and if developed, would

produce as much iron-ore as the equity owned in existing iron-ore projects

in the Pilbara by Rio Tinto and BHP Billiton.

"To delay, or worse still, possibly cancel two of the world's greatest

undeveloped resource projects will impact the Australian economy for

decades."

Edited by: Mariaan Webb

Tuesday, May 25, 2010

This tax will darken our future for years

Right now, miners have a fight on their hands to try to convince the Australian Govt to withdraw this proposed 40% super profits tax.

Here are just a few points to encourage you to write to your member of Parliament and to the Prime minister of Australia.

send an email to: ministerial@treasury.gov.au or phone +61 2 62777340

go to our other blog

Http://Noresourcestax.blogspot.com for more information.

This RSPT - Resource profit tax will harm Australian industry.

New ventures will not get access to international banking funds. If companies have to delay projects while this tax is "consulted" opportunities may be lost,and Australians will be worse off.

Jobs will be not be created, and worse still, some companies may even run projects at a loss and then get royalties refunded through the state coffers..

How ridiculous is that?