Miners are threatening to place ads during the election campaign.

well. so they should.

why? BECAUSE the Rudd/Gillard labor government engaged in PATTERN BARGAINING. essentially divide and conquer.

that's what the teamsters union do in the USA, and what our unions could do in AUSTRALIA. It's also what work choices was trying to stop.

LABOR picked an industry that they thought they could force to pay more money and one that they hoped that the voters would condone on moral grounds. THEN THEY picked only a few companies to force to an agreement. Then they would use that agreement to force others.

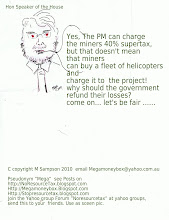

I oppose the mining tax because (1) it is against the constitution (you cannot create tax laws which might not treat the states fairly- in this case WA and QLD were being offered extra incentives.) and ( 2) because of this deceptive way of getting agreement instead of our representatives debating and creating a law about it..which could then be challenged in the supreme court.

(3) by abolishing the royalty system, labor is taking money from the states, and gaining more federally.

(4) Labor will target more industry sectors and bring them to heel one by one. It shouldn't be allowed.

(5) I also oppose the secrecy clauses in the PRRT (and in 176 other pieces of legislation.)

read these articles, and vote for me - Megan Sampson in the NSW senate.

http://www.theaustralian.com.au/business/mining-energy/newmont-mining-and-barrick-gold-threaten-newcrests-lihir-bid/story-e6frg9df-1225876664954

http://www.couriermail.com.au/news/clive-palmer-angry-over-mining-super-proft-taxation-advertisements/story-e6freon6-1225873061291

Thursday, July 22, 2010

Friday, July 16, 2010

Fed. Election announced 21st August 2010

So the election is announced for 21st August 2010., with the issue of writs on Monday(?)This will effectively cut off all new voters, and also the election will be fought on the old federal bondaries.

WHAT ARE THE MAIN ISSUES?

WELL JUST ABOUT EVERYTHING FROM ILLEGAL BOAT PEOPLE (PEACEFUL INVASION?) to employment, climate change, global financial crisis, schools funding and of course 50% tax deduction for school uniforms. etc etc.

Not much about the miners tax (MRRT) to the PRRT, yet anyway.

did you know that the PRRT has secrecy provisions as does 176 pieces of legislation.

Not just fines of $10,000 and or 2 years jail if you relay information but also saying you can't show a can't any documents from the company in question.

Might be great for AWB Directors but horrifying when you think that OUR government applies a law to prevent justice.

WHAT ARE THE MAIN ISSUES?

WELL JUST ABOUT EVERYTHING FROM ILLEGAL BOAT PEOPLE (PEACEFUL INVASION?) to employment, climate change, global financial crisis, schools funding and of course 50% tax deduction for school uniforms. etc etc.

Not much about the miners tax (MRRT) to the PRRT, yet anyway.

did you know that the PRRT has secrecy provisions as does 176 pieces of legislation.

Not just fines of $10,000 and or 2 years jail if you relay information but also saying you can't show a can't any documents from the company in question.

Might be great for AWB Directors but horrifying when you think that OUR government applies a law to prevent justice.

Sunday, July 4, 2010

RSPT R.I.P MRRT THE real reasons

The bigger picture about the RSPT and the MRRT is that the Australian industry groups (esp H Ridout et) were all pushing to get company tax down to King Henry's reform of 25%.

The Government promised company tax reduced from 30% to 28% so that it could get paid maternity leave and higher super through, without companies saying they couldnt afford it.

so who pays? the taxpayer. and who pays for the MRRT windfall ? the end users.

the taxpayer and the poor, in higher energy and other flow on costs.

Why should Woollies, Coles, banks, etc all pay less company tax ? especially with a double dip recession looming and the central banks (BIS) now pushing for higher interests rates and an end to stimulus. Mega from http://megamoneybox.blogspot.com

The Government promised company tax reduced from 30% to 28% so that it could get paid maternity leave and higher super through, without companies saying they couldnt afford it.

so who pays? the taxpayer. and who pays for the MRRT windfall ? the end users.

the taxpayer and the poor, in higher energy and other flow on costs.

Why should Woollies, Coles, banks, etc all pay less company tax ? especially with a double dip recession looming and the central banks (BIS) now pushing for higher interests rates and an end to stimulus. Mega from http://megamoneybox.blogspot.com

Friday, July 2, 2010

Divide and conquer and RENAME

PM Gillards anouncement yesterday of a breakthrough and a Victory, paved the way for individual industry sectors to have varying tax rates.It renamed the RSPT to a minerals tax. It was clever. It was quick, and it left many smaller miners out in the cold. It also opened the way to target silver, gold mining and everything else.

In an effort to be fair, I have listed both for and against viewpoints below.

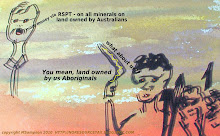

Of course what has not been discussed is the Joint ventures by Aboriginal communities with overseas companies who are not even listed on our ASX, which means Aussie shareholders cannot invest and benefit from these Joint Ventures. Nor does it mention Chinese/Indian ownership in full where takeovers have been made and the company has then delisted from the ASX. What amount of tax will these groups pay?

There will be a constitutional challenge, and the coming election will be fought on tax.The legislation for this tax willnot be presented to the senate until end 2011. so who willhold the balance of power in the senate? The greens want the tax, and will vote with Labor. The liberals are voting against it. It will all depend on who gets elected in the coming election tobe held before the end of the year. November is my latest guess, because Gillard wants to get some more victories under her belt before she goes to the polls.

The Government’s Standpoint

Current royalties and taxes fail to collect appropriate returns from private (what about foreign) companies extracting non-renewable resources that belong to the Australian people

The mining industry asked that any additional taxation needed to be applied to profits rather than the resource/minerals so they only paid extra tax when they were making money – (above a bond rate of 6% or now new up-lift of 12% GROSS PROFIT) this tax does just that.

The RSPT provides a more efficient mechanism for collecting a share of the returns to the community. (the non mining industry groups wanted a reduced company tax on Net profits to be 25%, now 29% which would help them pay more superannuation of 12%- for their employees)

The RSPT will encourage greater investment and employment in the resources sector.

The government has produced a Fact Sheet that fully outlines their rationale. You can get your copy here:

Resource Super Tax Fact Sheet

The Mining Industry Standpoint

The mining industry is more than happy to pay its fair share of taxes

The mining industry already pays its fair share of tax – $80 billion in the last decade

Mining companies pay corporate taxes just like every other corporation, plus they pay royalties; these taxes and royalties already give an effective tax rate of over 40%

The RSPT would raise the total effective rate to 58%,(2.07.10 the NEW minerals tax would now raise it to 42%) making it the highest tax rate in the world

Our biggest competitors, Canada and Brazil have tax rates of 23% and 27-38% respectively

Mining in Australia needs to be taxed at an internationally competitive rate

Current mining operations should not be taxed retrospectively (because the projects could have been started years ago) as these investments were made on the assumption of current tax rates.

Further details of the mining industry standpoint can be viewed at the Keeping Mining Strong website.

In an effort to be fair, I have listed both for and against viewpoints below.

Of course what has not been discussed is the Joint ventures by Aboriginal communities with overseas companies who are not even listed on our ASX, which means Aussie shareholders cannot invest and benefit from these Joint Ventures. Nor does it mention Chinese/Indian ownership in full where takeovers have been made and the company has then delisted from the ASX. What amount of tax will these groups pay?

There will be a constitutional challenge, and the coming election will be fought on tax.The legislation for this tax willnot be presented to the senate until end 2011. so who willhold the balance of power in the senate? The greens want the tax, and will vote with Labor. The liberals are voting against it. It will all depend on who gets elected in the coming election tobe held before the end of the year. November is my latest guess, because Gillard wants to get some more victories under her belt before she goes to the polls.

The Government’s Standpoint

Current royalties and taxes fail to collect appropriate returns from private (what about foreign) companies extracting non-renewable resources that belong to the Australian people

The mining industry asked that any additional taxation needed to be applied to profits rather than the resource/minerals so they only paid extra tax when they were making money – (above a bond rate of 6% or now new up-lift of 12% GROSS PROFIT) this tax does just that.

The RSPT provides a more efficient mechanism for collecting a share of the returns to the community. (the non mining industry groups wanted a reduced company tax on Net profits to be 25%, now 29% which would help them pay more superannuation of 12%- for their employees)

The RSPT will encourage greater investment and employment in the resources sector.

The government has produced a Fact Sheet that fully outlines their rationale. You can get your copy here:

Resource Super Tax Fact Sheet

The Mining Industry Standpoint

The mining industry is more than happy to pay its fair share of taxes

The mining industry already pays its fair share of tax – $80 billion in the last decade

Mining companies pay corporate taxes just like every other corporation, plus they pay royalties; these taxes and royalties already give an effective tax rate of over 40%

The RSPT would raise the total effective rate to 58%,(2.07.10 the NEW minerals tax would now raise it to 42%) making it the highest tax rate in the world

Our biggest competitors, Canada and Brazil have tax rates of 23% and 27-38% respectively

Mining in Australia needs to be taxed at an internationally competitive rate

Current mining operations should not be taxed retrospectively (because the projects could have been started years ago) as these investments were made on the assumption of current tax rates.

Further details of the mining industry standpoint can be viewed at the Keeping Mining Strong website.

Thursday, July 1, 2010

so Julia Gillard has a deadline for RSPT for Friday?

So deal or no deal.?.

Why should such an important tax be decided by Friday? I'd call it making a decision "under duress" for the miners.

They are in a bind even though they hold most of the cards.

If Gillard calls an election and wins, then she'll claim a mandate to impose the tax.

If the miners get some concessions before friday, and Gillard loses the election, then they may be able to get the new government to abolish the tax.

I bet the miners will try both. Appear to give concessions, and run the advertising campaign during the election.

and who will win the election?

my bet is that the silent majority are sick of labor, and judging by NSW polls, they will go.

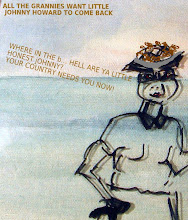

Where in the B.....Hell are ya ...Little Johnny?

Why should such an important tax be decided by Friday? I'd call it making a decision "under duress" for the miners.

They are in a bind even though they hold most of the cards.

If Gillard calls an election and wins, then she'll claim a mandate to impose the tax.

If the miners get some concessions before friday, and Gillard loses the election, then they may be able to get the new government to abolish the tax.

I bet the miners will try both. Appear to give concessions, and run the advertising campaign during the election.

and who will win the election?

my bet is that the silent majority are sick of labor, and judging by NSW polls, they will go.

Where in the B.....Hell are ya ...Little Johnny?

Subscribe to:

Posts (Atom)