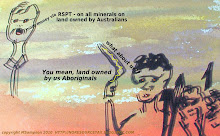

so the deal is: greens support the RSPT or maybe no second preferences from labor! or have we got it wong (ha ha joke)?

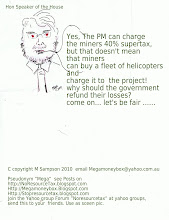

read below and beware. Mega's main reasons for opposing the RSPT is that

1. It is against the "fairness" of Australia. all companies and industries should be treated the same and are entitled to know that the amount of tax they have to pay is the same as other companies.

2. It will present a precedent for governments to then seek out other "high income" industries.

3 It is against the constitution re taxation. section 55 (i) and (ii). especially if WA and Qld are rewarded with a higher share of the revenues.

4. It has created an unnecessary division in Australia, rich against poor.

5. the RSPT tax will result in higher energy costs for Australians.The poor will pay.

below is an example of that division and how cleverly the Government has created a group to be hated.. Isn't that what Hitler did?

I'm sad to see that the greens are looking after their own political interest, in siding with and supporting labor, regarding this issue.

http://www.tradingroom.com.au/apps/view_breaking_news_article.ac?page=/data/news_research/published/2010/6/181/catf_100630_090100_3710.html

ERRA, June 30 AAP

June 30 2010, 09:01AM

Greens warn Labor on mining tax

The Australian Greens won't rule out dropping their support for Labor's proposed resource super-profits tax if the government caves in to pressure from mining companies.

But leader Bob Brown has stopped short of saying the minor party will try to block a modified tax plan in the Senate.

The government is keen to reach a settlement with the industry over the 40 per cent tax ahead of an election, to be held possibly as early as August.

The Greens would not look kindly on a "substantial cave-in against the public interest", Senator Brown said.

"Then we will be looking at that with a very jaundiced eye," he told ABC Radio on Wednesday.

The Greens are insisting any deal with industry maintains the $12 billion in revenue forecast in the budget's forward estimates.

Senator Brown said the mining companies were demonstrating brutal power by demanding the government meet their demands or risk a revival of the industry's advertising campaign against the tax.

"I am astonished as this very, very arrogant show of power from the mining corporations," he said.

Tuesday, June 29, 2010

Is this how it will pan out? divide and conquer?

So is this how it will pan out. the old Divide and conquer, with miners taking the best option. read article below from the business speculator, especially last para..

It won't really matter much if there is an early election.

The tax will lead to a constitutional challenge and should win. it is against section 55 (i) and (ii) plus possibly other sections. This government, if re-elected will try to impose it on other sectors...

Let's not give in now.

Julia's choice on RSPTStephen Bartholomeusz

Published 4:05 PM, 29 Jun 2010

--------------------------------------------------------------------------------

It would appear that we’ll soon know whether Julia Gillard was genuine when she said she wanted to negotiate with the mining industry over the proposed resource super profits tax, or whether she’s simply following the political strategy Kevin Rudd was pursuing before he was so abruptly dumped.

There are reports that Federal Cabinet is considering changes to the RSPT that would carve out the prospective coal seam gas-fed export LNG projects in Queensland, which would be covered by something akin to the existing petroleum resource rent tax. The RSPT could kill the projects and the planned tens-of-billions of investment in the new sector; under a PRRT they’d not pay a super tax on profits for probably the best part of a decade, if not more.

Changes to the super tax treatment of the CSG projects, or exclusion of low-value resources, or even smaller mines, would have minimal impact on the revenue collected from a RSPT, particularly if the government abandoned the tax credit for losses that no-one in the industry values or wants.

Therefore the government could appear to make very major concessions to the industry with minimal impact on the revenue the tax raises – indeed it might raise more than the $9 billion a year it is expected to generate without the transferable tax credit scheme.

Gillard could even raise the controversial uplift factor in the tax from the government bond rate of less than 6 per cent to the 11 per cent or so in the PRRT without making any real concession to the miners who will pay the overwhelming majority of the tax; the big mining houses with long-established mines and the iron ore and export-coal producers, in particular.

That would, however, be a highly political strategy – it was the strategy being developed by Kevin Rudd and Wayne Swan before Gillard displaced Rudd. It was designed to fragment the hitherto united industry opposition to the RSPT, isolating BHP Billiton, Rio Tinto, Xstrata and the other big miners and enabling the government to portray them as obdurate and greedy and absolutely committed to not paying a "fairer" share of tax.

The mining industry campaign would lose a lot of its potency if the industry’s solidarity was broken and it was being prosecuted only by a relative handful of the biggest players. A politically driven strategy would, however, also be a breach of Gillard’s promise to negotiate in good faith. The industry gave her the benefit of the doubt when it froze its campaign.

If she is genuine, and is genuinely concerned about the long-term best interests of the economy, rather than the short-term funding of Rudd and Swan’s planned pre-election spending spree – and the bigger miners appear to believe that she might be (while worrying about the influence of Swan and Treasury) – then the tax needs to be completely re-thought.

The headline rate of 40 per cent needs to be significantly reduced and the up-lift factor significantly increased and applied, not to the written-down book values of the mines, but to something approximating their current value to abandon the retrospectivity of the proposed tax. A re-thought tax also ought to discriminate between different types of resources and their different margin and capital expenditure profiles.

The Australian miners do compete in global markets and there is global competition for their capital. The long-term national interest dictates that any changes to the tax regime don’t undermine their competitiveness or divert capital to competing jurisdictions.

If Gillard includes the big miners in her negotiated responses to the exposed issues with the RSPT she will have demonstrated that she was being genuine when she identified the need to negotiate rather than consult with the industry as one of her earliest and most urgent priorities.

That might mean junking Swan’s budget strategy and the projected spending paid for by the tax; which won’t reflect well on Swan, but that’s a "price" worth paying to clear the way for a new tax on genuine super profits (rather than a super tax on normal profits) that doesn’t damage the sector and Australia’s reputation as a stable place for investment.

It won't really matter much if there is an early election.

The tax will lead to a constitutional challenge and should win. it is against section 55 (i) and (ii) plus possibly other sections. This government, if re-elected will try to impose it on other sectors...

Let's not give in now.

Julia's choice on RSPTStephen Bartholomeusz

Published 4:05 PM, 29 Jun 2010

--------------------------------------------------------------------------------

It would appear that we’ll soon know whether Julia Gillard was genuine when she said she wanted to negotiate with the mining industry over the proposed resource super profits tax, or whether she’s simply following the political strategy Kevin Rudd was pursuing before he was so abruptly dumped.

There are reports that Federal Cabinet is considering changes to the RSPT that would carve out the prospective coal seam gas-fed export LNG projects in Queensland, which would be covered by something akin to the existing petroleum resource rent tax. The RSPT could kill the projects and the planned tens-of-billions of investment in the new sector; under a PRRT they’d not pay a super tax on profits for probably the best part of a decade, if not more.

Changes to the super tax treatment of the CSG projects, or exclusion of low-value resources, or even smaller mines, would have minimal impact on the revenue collected from a RSPT, particularly if the government abandoned the tax credit for losses that no-one in the industry values or wants.

Therefore the government could appear to make very major concessions to the industry with minimal impact on the revenue the tax raises – indeed it might raise more than the $9 billion a year it is expected to generate without the transferable tax credit scheme.

Gillard could even raise the controversial uplift factor in the tax from the government bond rate of less than 6 per cent to the 11 per cent or so in the PRRT without making any real concession to the miners who will pay the overwhelming majority of the tax; the big mining houses with long-established mines and the iron ore and export-coal producers, in particular.

That would, however, be a highly political strategy – it was the strategy being developed by Kevin Rudd and Wayne Swan before Gillard displaced Rudd. It was designed to fragment the hitherto united industry opposition to the RSPT, isolating BHP Billiton, Rio Tinto, Xstrata and the other big miners and enabling the government to portray them as obdurate and greedy and absolutely committed to not paying a "fairer" share of tax.

The mining industry campaign would lose a lot of its potency if the industry’s solidarity was broken and it was being prosecuted only by a relative handful of the biggest players. A politically driven strategy would, however, also be a breach of Gillard’s promise to negotiate in good faith. The industry gave her the benefit of the doubt when it froze its campaign.

If she is genuine, and is genuinely concerned about the long-term best interests of the economy, rather than the short-term funding of Rudd and Swan’s planned pre-election spending spree – and the bigger miners appear to believe that she might be (while worrying about the influence of Swan and Treasury) – then the tax needs to be completely re-thought.

The headline rate of 40 per cent needs to be significantly reduced and the up-lift factor significantly increased and applied, not to the written-down book values of the mines, but to something approximating their current value to abandon the retrospectivity of the proposed tax. A re-thought tax also ought to discriminate between different types of resources and their different margin and capital expenditure profiles.

The Australian miners do compete in global markets and there is global competition for their capital. The long-term national interest dictates that any changes to the tax regime don’t undermine their competitiveness or divert capital to competing jurisdictions.

If Gillard includes the big miners in her negotiated responses to the exposed issues with the RSPT she will have demonstrated that she was being genuine when she identified the need to negotiate rather than consult with the industry as one of her earliest and most urgent priorities.

That might mean junking Swan’s budget strategy and the projected spending paid for by the tax; which won’t reflect well on Swan, but that’s a "price" worth paying to clear the way for a new tax on genuine super profits (rather than a super tax on normal profits) that doesn’t damage the sector and Australia’s reputation as a stable place for investment.

Friday, June 25, 2010

Don't cave in.. the election is nigh. RSPT must be abolished

Don't cave in, otherwise the RSPT will become a precedent for other industries. Tax laws need to be fair and the same for all companies / people. They can't be retrospective, and can't be dreamed up and implemented without scrutiny.

Time is on the side of the miners, as long as they don't let themselves be rushed into a deal. Wayne Swan and Julia Gillard have painted themselves into a corner, and wont give up. The electors will show their displeasure at the election to be held before the end of the year.

There's heaps of press articles, and here's one link worth following.

--------------------------------------------------------------------------------

Gillard must mop up Swan's messAlan Kohler

Published 7:47 AM, 25 Jun 2010 Last update 10:16 AM, 25 Jun 2010 reference

http://www.businessspectator.com.au/bs.nsf/Article/Minerals-Council-Julia-Gillard-RSPT-Kevin-Rudd-ren-pd20100625-6R4VY?OpenDocument&src=mp

--------------------------------------------------------------------------------

Treasurer Wayne Swan, architect of the stinker of a budget handed down in May, must now work quickly with Prime Minister Gillard to release a mini-budget that makes sense.

Time is on the side of the miners, as long as they don't let themselves be rushed into a deal. Wayne Swan and Julia Gillard have painted themselves into a corner, and wont give up. The electors will show their displeasure at the election to be held before the end of the year.

There's heaps of press articles, and here's one link worth following.

--------------------------------------------------------------------------------

Gillard must mop up Swan's messAlan Kohler

Published 7:47 AM, 25 Jun 2010 Last update 10:16 AM, 25 Jun 2010 reference

http://www.businessspectator.com.au/bs.nsf/Article/Minerals-Council-Julia-Gillard-RSPT-Kevin-Rudd-ren-pd20100625-6R4VY?OpenDocument&src=mp

--------------------------------------------------------------------------------

Treasurer Wayne Swan, architect of the stinker of a budget handed down in May, must now work quickly with Prime Minister Gillard to release a mini-budget that makes sense.

Wednesday, June 23, 2010

twiggy didnt cave in.. and Gillard gets top job.

J Gillard announced as PM,this morning at 9.30

The woman with tuck shops the size of cubby houses as her monument.

Don't expect any change, but maybe a quick election announcement..

Here's the lastest about twiggy. Good to see he didn't give in...

http://www.businessspectator.com.au/bs.nsf/Article/Fortescue-not-swayed-by-govt-RSPT-offer-report-pd20100624-6PRK9?opendocument&src=rss

Fortescue not swayed by govt RSPT offer: report

QUICK SUMMARY | FULL STORY | RSPT | COMMENT

Iron ore miner Fortescue Metals Group Ltd has refused to be swayed by federal government attempts to entice the company to support the proposed 40 per cent resources super profits tax (RSPT), The Australian reports.

It is believed that Fortescue chief executive Andrew Forrest is not satisfied with the government's suggestion that the treatment of capital could be altered to help the company with large-scale borrowing to fund expansion.

The company is understood to have told Treasury officials that any such changes would merely be a short-term fix to suit one company, and would not solve the broader, long-term problems the mining industry sees with the tax, the newspaper said.

Mr Forrest has been a vocal opponent of the RSPT, and the government's suggestion is believed to be part of a concerted effort to break up the united wall of resistance from resource sector heavies.

Canberra's attempt to sway Fortescue highlights the ongoing struggle the government has had making any in-roads with persuading industry giants BHP Billiton Ltd, Rio Tinto Ltd and Xstrata to come on board.

Yesterday, Prime Minister Kevin Rudd urged mining companies not yet engaged in negotiations with the government over the resource super profits tax to do so now.

The woman with tuck shops the size of cubby houses as her monument.

Don't expect any change, but maybe a quick election announcement..

Here's the lastest about twiggy. Good to see he didn't give in...

http://www.businessspectator.com.au/bs.nsf/Article/Fortescue-not-swayed-by-govt-RSPT-offer-report-pd20100624-6PRK9?opendocument&src=rss

Fortescue not swayed by govt RSPT offer: report

QUICK SUMMARY | FULL STORY | RSPT | COMMENT

Iron ore miner Fortescue Metals Group Ltd has refused to be swayed by federal government attempts to entice the company to support the proposed 40 per cent resources super profits tax (RSPT), The Australian reports.

It is believed that Fortescue chief executive Andrew Forrest is not satisfied with the government's suggestion that the treatment of capital could be altered to help the company with large-scale borrowing to fund expansion.

The company is understood to have told Treasury officials that any such changes would merely be a short-term fix to suit one company, and would not solve the broader, long-term problems the mining industry sees with the tax, the newspaper said.

Mr Forrest has been a vocal opponent of the RSPT, and the government's suggestion is believed to be part of a concerted effort to break up the united wall of resistance from resource sector heavies.

Canberra's attempt to sway Fortescue highlights the ongoing struggle the government has had making any in-roads with persuading industry giants BHP Billiton Ltd, Rio Tinto Ltd and Xstrata to come on board.

Yesterday, Prime Minister Kevin Rudd urged mining companies not yet engaged in negotiations with the government over the resource super profits tax to do so now.

Monday, June 21, 2010

so is this the answer??

Latest Commentary

from "the business speculator"

China's RSPT bounty

STEPHEN BARTHOLOMEUSZ The Rudd government's resource super profits tax will force miners to ask China's state-owned financiers for cash, bringing in more Chinese state-owned enterprises as shareholders. 4:13 PM read more

http://www.businessspectator.com.au/bs.nsf/Article/Bartholomeusz-RSPT-iron-ore-China-Development-Bank-pd20100621-6M8YT?OpenDocument&src=pmm

Commentary

4:13 PM, 21 Jun 2010

| More

Stephen Bartholomeusz

China's RSPT bounty

Kevin Rudd might want to characterise the $10 billion or so of deals with China unveiled today during the visit of Chinese vice-president Xi Jinping as evidence that the resource super profits tax is not affecting investment, but then the Chinese are not your ordinary investors.

And, indeed, given that China Development Bank (CDB) features in several of the resource deals signed today, the deals themselves aren’t necessarily conventional resource sector investments.

The Chinese might be a little annoyed that the RSPT was announced after their state-owned enterprises had invested tens of billions of dollars in the Australian resource sector but (a) their deals are likely to be the least affected by the RSPT (with a couple of exceptions) and (b) they aren’t necessarily as fixated with profitability as Australian miners.

It needs to be remembered that the Rudd government has hailed the tax – which would be paid largely by the big miners on well-established low-cost and highly profitable mines – as helping to promote hitherto marginal production within the sector. Its initial impact is positive for new and high-cost/low quality mines.

China is unlikely to be fussed if the big iron ore and metallurgical coal producers are less competitive, relative to their international peers, as a result of the tax, given the paranoia of its big steel producers about the level of influence and market power the producers have over key inputs into China’s industrial activity.

Conversely, it is in China’s own long-term interests to encourage new sources of iron ore and coal and other commodities to increase supply, temper price rises and counter the influence of the global resource groups.

Indeed, much of China’s activity in Australia in the past has been focused on the emerging iron ore producers like Fortescue and the Mid West iron ore province, which could be classified as marginal producers.

The memorandums of understanding China Development Bank has signed with Aquila Resources and Karara Mining – they both have West Australian iron ore projects in which there are pre-existing Chinese partners – fit the kind of strategy that is more interested in security of supply, increased supply and wider available sources of supply than in its absolute profitability.

Helping to finance the Oakajee port and rail infrastructure that helps open up the Mid West is a relatively obvious way for CDB to facilitate China’s strategic interests.

There is, potentially, enormous mutual interest in partnering with the Chinese to bring new projects and resource provinces into production.

That, however, doesn’t validate the proposed tax, which would amplify the strategic benefits the Chinese are seeking by slowing expansion of the production of our most efficient iron ore and coal producers – the ones able to use their market position to maximise the value received from exploiting those resources.

The other issue raised by the tax, and one that Fortescue’s Andrew Forrest has been particularly critical of, is that it will effectively destroy conventional project financing because the RSPT applies before financing costs.

To obtain project funding, smaller producers – who traditionally have used project financing to develop their mines – will have to turn to financiers more interested in gaining access to supply than in the security of their loans.

That almost inevitably means bringing in Chinese state-owned enterprises as shareholders and asking the Chinese state-owned financiers for help with the debt component. The impact of the RSPT would dictate that miners looked to financiers less interested in profitability than conventional capital providers.

One suspects that Rudd and Wayne Swan – both very sensitive to the politics of Chinese investment in the past – haven’t properly thought through the implications for Chinese interest in Australian resources of a RSPT that encourages marginal production during a boom, discourages conventional financing and commits the taxpayer to underwriting 40 per cent of the losses in a downturn.

from "the business speculator"

China's RSPT bounty

STEPHEN BARTHOLOMEUSZ The Rudd government's resource super profits tax will force miners to ask China's state-owned financiers for cash, bringing in more Chinese state-owned enterprises as shareholders. 4:13 PM read more

http://www.businessspectator.com.au/bs.nsf/Article/Bartholomeusz-RSPT-iron-ore-China-Development-Bank-pd20100621-6M8YT?OpenDocument&src=pmm

Commentary

4:13 PM, 21 Jun 2010

| More

Stephen Bartholomeusz

China's RSPT bounty

Kevin Rudd might want to characterise the $10 billion or so of deals with China unveiled today during the visit of Chinese vice-president Xi Jinping as evidence that the resource super profits tax is not affecting investment, but then the Chinese are not your ordinary investors.

And, indeed, given that China Development Bank (CDB) features in several of the resource deals signed today, the deals themselves aren’t necessarily conventional resource sector investments.

The Chinese might be a little annoyed that the RSPT was announced after their state-owned enterprises had invested tens of billions of dollars in the Australian resource sector but (a) their deals are likely to be the least affected by the RSPT (with a couple of exceptions) and (b) they aren’t necessarily as fixated with profitability as Australian miners.

It needs to be remembered that the Rudd government has hailed the tax – which would be paid largely by the big miners on well-established low-cost and highly profitable mines – as helping to promote hitherto marginal production within the sector. Its initial impact is positive for new and high-cost/low quality mines.

China is unlikely to be fussed if the big iron ore and metallurgical coal producers are less competitive, relative to their international peers, as a result of the tax, given the paranoia of its big steel producers about the level of influence and market power the producers have over key inputs into China’s industrial activity.

Conversely, it is in China’s own long-term interests to encourage new sources of iron ore and coal and other commodities to increase supply, temper price rises and counter the influence of the global resource groups.

Indeed, much of China’s activity in Australia in the past has been focused on the emerging iron ore producers like Fortescue and the Mid West iron ore province, which could be classified as marginal producers.

The memorandums of understanding China Development Bank has signed with Aquila Resources and Karara Mining – they both have West Australian iron ore projects in which there are pre-existing Chinese partners – fit the kind of strategy that is more interested in security of supply, increased supply and wider available sources of supply than in its absolute profitability.

Helping to finance the Oakajee port and rail infrastructure that helps open up the Mid West is a relatively obvious way for CDB to facilitate China’s strategic interests.

There is, potentially, enormous mutual interest in partnering with the Chinese to bring new projects and resource provinces into production.

That, however, doesn’t validate the proposed tax, which would amplify the strategic benefits the Chinese are seeking by slowing expansion of the production of our most efficient iron ore and coal producers – the ones able to use their market position to maximise the value received from exploiting those resources.

The other issue raised by the tax, and one that Fortescue’s Andrew Forrest has been particularly critical of, is that it will effectively destroy conventional project financing because the RSPT applies before financing costs.

To obtain project funding, smaller producers – who traditionally have used project financing to develop their mines – will have to turn to financiers more interested in gaining access to supply than in the security of their loans.

That almost inevitably means bringing in Chinese state-owned enterprises as shareholders and asking the Chinese state-owned financiers for help with the debt component. The impact of the RSPT would dictate that miners looked to financiers less interested in profitability than conventional capital providers.

One suspects that Rudd and Wayne Swan – both very sensitive to the politics of Chinese investment in the past – haven’t properly thought through the implications for Chinese interest in Australian resources of a RSPT that encourages marginal production during a boom, discourages conventional financing and commits the taxpayer to underwriting 40 per cent of the losses in a downturn.

australia -chinese deal announced today?!?

What will this mean to the miners RSPT? no wonder the Government wanted to get its hand on some of this money...

so who owns Australia now?

announcement:

China to invest billions in Australian energy, resource deals

* From: AAP

* June 21, 2010 12:59PM

CHINESE companies will build mines, railways and port facilities in Australia under a series of billion-dollar resources deals signed in Canberra.

Chinese Vice-President Xi Jinpeng inked the deals in meetings with Prime Minister Kevin Rudd.

China is Australia's largest trading partner, and its thirst for iron ore and natural gas helped keep Australia out of the global recession.

Mr Rudd said the 10 deals focused on resources and energy.

"This demonstrates the dynamic relations between the two countries in this sector, and the strong complementarity of the two economies," he said.

Under one deal, Chinese companies will help fund a $US8 billion ($9.1 billion) coal mine, railway and coal-loading terminal near Bowen in Queensland.

Mr Rudd said that deal would yield $4 billion in exports each year for 25 years.

Another deal commits Chinese experts and engineers to work on the expansion of Fortescue's iron ore projects in the Pilbara region of Western Australia, which Mr Rudd says will be worth $5 billion a year in exports.

Fortescue boss Andrew "Twiggy" Forrest is a vocal opponent of the Government's proposed new mining tax.

China Development Bank will provide $US1.2 billion for a joint venture to build a new port and rail facilities at Oakajee in Western Australia, and invest in Aquila's coal and iron ore projects in the Pilbara.

Not all of the deals involve resources.

A new quarantine arrangement will allow for Tasmanian apples to be exported to China, while other deals aim at cooperation in education and telecommunications.

so who owns Australia now?

announcement:

China to invest billions in Australian energy, resource deals

* From: AAP

* June 21, 2010 12:59PM

CHINESE companies will build mines, railways and port facilities in Australia under a series of billion-dollar resources deals signed in Canberra.

Chinese Vice-President Xi Jinpeng inked the deals in meetings with Prime Minister Kevin Rudd.

China is Australia's largest trading partner, and its thirst for iron ore and natural gas helped keep Australia out of the global recession.

Mr Rudd said the 10 deals focused on resources and energy.

"This demonstrates the dynamic relations between the two countries in this sector, and the strong complementarity of the two economies," he said.

Under one deal, Chinese companies will help fund a $US8 billion ($9.1 billion) coal mine, railway and coal-loading terminal near Bowen in Queensland.

Mr Rudd said that deal would yield $4 billion in exports each year for 25 years.

Another deal commits Chinese experts and engineers to work on the expansion of Fortescue's iron ore projects in the Pilbara region of Western Australia, which Mr Rudd says will be worth $5 billion a year in exports.

Fortescue boss Andrew "Twiggy" Forrest is a vocal opponent of the Government's proposed new mining tax.

China Development Bank will provide $US1.2 billion for a joint venture to build a new port and rail facilities at Oakajee in Western Australia, and invest in Aquila's coal and iron ore projects in the Pilbara.

Not all of the deals involve resources.

A new quarantine arrangement will allow for Tasmanian apples to be exported to China, while other deals aim at cooperation in education and telecommunications.

What does twiggy know taht we don't?

What does twiggy ASX:FMG know that we don't?

is there a back room deal here?

we need to see it all on the table asap.

http://m.foxbusiness.com/quickPage.html?page=19453&content=39788027

Fortescue Metals CEO: Proposed Mining Tax Can't Be Justified

Jun 21, 2010 12:50 AM EDT

CANBERRA -(Dow Jones)- Fortescue Metals Group Ltd. (FMG.AU) Chief Executive Andrew Forrest said Monday the government's proposed resource super profits tax was "now officially dead," it can't be economically justified and is harming Australia's economy daily.

If the tax proposal proceeds it won't look anything like the "dreadful economy-smashing" tax that was put forward in early May, he told reporters.

Asked about comments by Treasury Secretary Ken Henry that negotiations about the tax would take months, Forrest said he "wouldn't have thought

is there a back room deal here?

we need to see it all on the table asap.

http://m.foxbusiness.com/quickPage.html?page=19453&content=39788027

Fortescue Metals CEO: Proposed Mining Tax Can't Be Justified

Jun 21, 2010 12:50 AM EDT

CANBERRA -(Dow Jones)- Fortescue Metals Group Ltd. (FMG.AU) Chief Executive Andrew Forrest said Monday the government's proposed resource super profits tax was "now officially dead," it can't be economically justified and is harming Australia's economy daily.

If the tax proposal proceeds it won't look anything like the "dreadful economy-smashing" tax that was put forward in early May, he told reporters.

Asked about comments by Treasury Secretary Ken Henry that negotiations about the tax would take months, Forrest said he "wouldn't have thought

Friday, June 18, 2010

The PM. 1+ 1 = 1000, or a 1,000,000 The multiplier effect

The multiplier effect. When one person speaks out, others follow. and 1+1 means more than 2. Especially on the internet. It's good to see us bloggers joining together and achieving a response. On Friday the prime minister was seen complaining on TV that

"all these journalists and bloggers writing on the internet and opposing the RSPT."

On Thursday. 17.06.2010 - On the ABCTV 7.30 Report, Kerry O'Brien took the PM to task about his throwaway line said about the miners..

that "we have long memories." as if it was a threat.

The PM rejected this and defended his throwaway line, said at a private function.

But I'm sure this line will be remembered and will be his downfall.

I think I'll do another cartoon, and twitter it to him. you can twitter me at megamoneybox. KRudd the PM is a follower of mine..

but I hope he doesn't remember us..

"all these journalists and bloggers writing on the internet and opposing the RSPT."

On Thursday. 17.06.2010 - On the ABCTV 7.30 Report, Kerry O'Brien took the PM to task about his throwaway line said about the miners..

that "we have long memories." as if it was a threat.

The PM rejected this and defended his throwaway line, said at a private function.

But I'm sure this line will be remembered and will be his downfall.

I think I'll do another cartoon, and twitter it to him. you can twitter me at megamoneybox. KRudd the PM is a follower of mine..

but I hope he doesn't remember us..

Monday, June 14, 2010

the battle continues.

If you watched question time (parliament Australia) today and listened to the discussion you would have heard many times "Australia is going to have a superprofits tax" (Ferguson)You would be forgiven for wondering if there are more industries in their sights. There doesn't seem to be much room for negotiation.

If the government made an announcement declaring that: a supertax is going to apply to your chemist/dress shop/ newsagentcy/ car dealership or on the sale of your house - or that you will have to pay a 40% supertax on all profit over 6%.. what would you say?

start writing your response now.

this little battle for democracy is getting more revealing by the day.

Here's a news item from Brisbane today.

http://au.biz.yahoo.com/100615/31/2dmub.html

Proposed resources tax under fire at Brisbane forum

Tuesday June 15, 2010, 1:00 pm

The mining sector has continued its assault on the Federal Government's proposed resources tax at an industry conference in Brisbane.

Access Economics director Chris Richardson told the forum the tax is based on the flawed belief that the mining bonanza will continue forever.

"It may be that we end up shooting ourselves in the foot - that we slow down the sector through the period when these magic margins are at their best," he said.

Mr Richardson says the levy would tax entrepreneurial effort as well as minerals.

Minerals Council spokesman Mitch Hooke says the Government has deliberately misrepresented the sector's tax contribution.

"[It's] probably one of the most significant assaults on an industry that I've seen in my 20 years as a CEO in Canberra," he said.

Similar meetings will be held in Western Australia and South Australia later this week.

If the government made an announcement declaring that: a supertax is going to apply to your chemist/dress shop/ newsagentcy/ car dealership or on the sale of your house - or that you will have to pay a 40% supertax on all profit over 6%.. what would you say?

start writing your response now.

this little battle for democracy is getting more revealing by the day.

Here's a news item from Brisbane today.

http://au.biz.yahoo.com/100615/31/2dmub.html

Proposed resources tax under fire at Brisbane forum

Tuesday June 15, 2010, 1:00 pm

The mining sector has continued its assault on the Federal Government's proposed resources tax at an industry conference in Brisbane.

Access Economics director Chris Richardson told the forum the tax is based on the flawed belief that the mining bonanza will continue forever.

"It may be that we end up shooting ourselves in the foot - that we slow down the sector through the period when these magic margins are at their best," he said.

Mr Richardson says the levy would tax entrepreneurial effort as well as minerals.

Minerals Council spokesman Mitch Hooke says the Government has deliberately misrepresented the sector's tax contribution.

"[It's] probably one of the most significant assaults on an industry that I've seen in my 20 years as a CEO in Canberra," he said.

Similar meetings will be held in Western Australia and South Australia later this week.

Sunday, June 13, 2010

the bigger picture

Rudd announces chemists cSPT? (Chemist super profits tax)

We might need to tax the foreign comapnies who have made deals with aboriginal groups, and who are not on the asx, but to become a joint partner and subsidise losses via the taxpayer is ridiculous. To tax a company 40% above the bond rate (say 6%)is socialism. There's been no legislation put up, no real discussion and what industry will be next? Mega from http://noresourcetax.blogspot.com says Beware for our future.

Why not a chemist supertax? they make money from already taxpayer funded doctors prescriptions.. or pathologists..they make money from taxpayers and bleed the govt dry! Rudd imposed a RSPT while reducing company tax from 30% to 28%? He gives in one hand, takes away in the other..

We might need to tax the foreign comapnies who have made deals with aboriginal groups, and who are not on the asx, but to become a joint partner and subsidise losses via the taxpayer is ridiculous. To tax a company 40% above the bond rate (say 6%)is socialism. There's been no legislation put up, no real discussion and what industry will be next? Mega from http://noresourcetax.blogspot.com says Beware for our future.

Why not a chemist supertax? they make money from already taxpayer funded doctors prescriptions.. or pathologists..they make money from taxpayers and bleed the govt dry! Rudd imposed a RSPT while reducing company tax from 30% to 28%? He gives in one hand, takes away in the other..

Friday, June 11, 2010

BHP slams RSPT

ref http://www.proactiveinvestors.co.uk/companies/news/17568/bhp-billiton-chairman-jac-nasser-slams-australian-mining-super-tax-17568.html

Friday, June 11, 2010 by Jamie Ashcroft

BHP noted its disappointment that such a consultation has not been possible in relation to the ‘super-tax’. “Therefore the government missed the opportunity to have Treasury's theory tested by practical experience and industry knowledge”, Nasser stated.

“We always welcome the opportunity to consult but unfortunately ... there has been no acknowledgement by the government of the major flaws of the proposed tax and the significant impact on the industry”. BHP said it is not against tax reform, but it believes that the principles of sound tax reform are not present in the current proposal.

“The 40 per cent super tax rate, in addition to company tax, will make the Australian mineral resources industry the highest taxed in the world and uncompetitive with other resource-rich nations. An uncompetitive tax rate is a fundamental problem.”

“The super tax will apply to existing projects, fundamentally changing the rules when billions of dollars have already been invested.”

According to BHP, any new tax on the minerals resources industry should: Not fundamentally change the rules of the game on existing projects; Ensure that overall tax is competitive with other mineral resources countries; Vary between the kind of mineral resources mined; Be applied on the value of minerals alone.

Otherwise, the company believes that the proposal could damage Australia's reputation as a stable and fair place for investment, the country could lose investment to countries with more attractive tax rates, and it could unintentionally penalise investments in infrastructure, processing or other support activities.

“The Australian government needs to understand the real world impact of the proposed super tax or it will hurt the Australian minerals industry and hurt Australia's future,” Nasser said.

BHP also told its shareholders that it wanted to set the record straight, in terms of its own tax payments in Australia. “The government has not accurately represented the level of taxes we pay on our Australian operations ... It concerns BHP Billiton that inappropriate conclusions appear to have been drawn ... Total taxes paid by BHP Billiton's Australian operations in relation to the financial years 2004 to 2009 inclusive exceed A$24 billion."

“The 2009 earnings of BHP Billiton's Australian operations were almost fully reinvested back in Australia,” he added

Friday, June 11, 2010 by Jamie Ashcroft

BHP noted its disappointment that such a consultation has not been possible in relation to the ‘super-tax’. “Therefore the government missed the opportunity to have Treasury's theory tested by practical experience and industry knowledge”, Nasser stated.

“We always welcome the opportunity to consult but unfortunately ... there has been no acknowledgement by the government of the major flaws of the proposed tax and the significant impact on the industry”. BHP said it is not against tax reform, but it believes that the principles of sound tax reform are not present in the current proposal.

“The 40 per cent super tax rate, in addition to company tax, will make the Australian mineral resources industry the highest taxed in the world and uncompetitive with other resource-rich nations. An uncompetitive tax rate is a fundamental problem.”

“The super tax will apply to existing projects, fundamentally changing the rules when billions of dollars have already been invested.”

According to BHP, any new tax on the minerals resources industry should: Not fundamentally change the rules of the game on existing projects; Ensure that overall tax is competitive with other mineral resources countries; Vary between the kind of mineral resources mined; Be applied on the value of minerals alone.

Otherwise, the company believes that the proposal could damage Australia's reputation as a stable and fair place for investment, the country could lose investment to countries with more attractive tax rates, and it could unintentionally penalise investments in infrastructure, processing or other support activities.

“The Australian government needs to understand the real world impact of the proposed super tax or it will hurt the Australian minerals industry and hurt Australia's future,” Nasser said.

BHP also told its shareholders that it wanted to set the record straight, in terms of its own tax payments in Australia. “The government has not accurately represented the level of taxes we pay on our Australian operations ... It concerns BHP Billiton that inappropriate conclusions appear to have been drawn ... Total taxes paid by BHP Billiton's Australian operations in relation to the financial years 2004 to 2009 inclusive exceed A$24 billion."

“The 2009 earnings of BHP Billiton's Australian operations were almost fully reinvested back in Australia,” he added

Thursday, June 10, 2010

don't get sucked in...

The AWU Paul Howes is mobilising supporters. NSW/Illawarra miners to support the government..

and todays news article

http://au.news.yahoo.com/a/-/latest/7384405/pm-promises-billions-for-infrastructure/

Prime Minister Kevin Rudd has promised more than $2 billion in infrastructure funding for Queensland as he continues the hard-sell of his mining tax.

Queensland and Western Australia are each getting more than $2 billion for infrastructure under a new $6 billion regional infrastructure fund, using proceeds from the super-profits tax.

Mr Rudd on Friday confirmed Queensland could expect a $2 billion boost from the fund.

The state's mining centres such as Mackay, Gladstone, Rockhampton and Townsville will be able to compete for the funding, he said in a statement.

"The government believes it is time to put something back into the mining communities, and those communities which support them, that give so much to Australia and make our national economy strong," the statement said.

"That means more rail, roads, ports, and other crucial infrastructure to support the workforce in critical mining regions and in communities that support mining regions."

The announcement came as Mr Rudd met with miners and representatives from the Construction, Forestry, Mining, Energy Union at the Mackay Surf Club.

Earlier in the day, Mr Rudd was forced to hose down reports a compromise on the super-profits resource tax was imminent.

He said there was still "weeks and probably months" of consultation with Australia's big mining companies ahead for the government.

Comment was being sought from the Queensland government.

and todays news article

http://au.news.yahoo.com/a/-/latest/7384405/pm-promises-billions-for-infrastructure/

Prime Minister Kevin Rudd has promised more than $2 billion in infrastructure funding for Queensland as he continues the hard-sell of his mining tax.

Queensland and Western Australia are each getting more than $2 billion for infrastructure under a new $6 billion regional infrastructure fund, using proceeds from the super-profits tax.

Mr Rudd on Friday confirmed Queensland could expect a $2 billion boost from the fund.

The state's mining centres such as Mackay, Gladstone, Rockhampton and Townsville will be able to compete for the funding, he said in a statement.

"The government believes it is time to put something back into the mining communities, and those communities which support them, that give so much to Australia and make our national economy strong," the statement said.

"That means more rail, roads, ports, and other crucial infrastructure to support the workforce in critical mining regions and in communities that support mining regions."

The announcement came as Mr Rudd met with miners and representatives from the Construction, Forestry, Mining, Energy Union at the Mackay Surf Club.

Earlier in the day, Mr Rudd was forced to hose down reports a compromise on the super-profits resource tax was imminent.

He said there was still "weeks and probably months" of consultation with Australia's big mining companies ahead for the government.

Comment was being sought from the Queensland government.

Don't get sucked in, with promises see the legislation

http://au.news.yahoo.com/a/-/latest/7384405/pm-promises-billions-for-infrastructure/

Prime Minister Kevin Rudd has promised more than $2 billion in infrastructure funding for Queensland as he continues the hard-sell of his mining tax.

Queensland and Western Australia are each getting more than $2 billion for infrastructure under a new $6 billion regional infrastructure fund, using proceeds from the super-profits tax.

Mr Rudd on Friday confirmed Queensland could expect a $2 billion boost from the fund.

The state's mining centres such as Mackay, Gladstone, Rockhampton and Townsville will be able to compete for the funding, he said in a statement.

"The government believes it is time to put something back into the mining communities, and those communities which support them, that give so much to Australia and make our national economy strong," the statement said.

"That means more rail, roads, ports, and other crucial infrastructure to support the workforce in critical mining regions and in communities that support mining regions."

The announcement came as Mr Rudd met with miners and representatives from the Construction, Forestry, Mining, Energy Union at the Mackay Surf Club.

Earlier in the day, Mr Rudd was forced to hose down reports a compromise on the super-profits resource tax was imminent.

He said there was still "weeks and probably months" of consultation with Australia's big mining companies ahead for the government.

Comment was being sought from the Queensland government.

Prime Minister Kevin Rudd has promised more than $2 billion in infrastructure funding for Queensland as he continues the hard-sell of his mining tax.

Queensland and Western Australia are each getting more than $2 billion for infrastructure under a new $6 billion regional infrastructure fund, using proceeds from the super-profits tax.

Mr Rudd on Friday confirmed Queensland could expect a $2 billion boost from the fund.

The state's mining centres such as Mackay, Gladstone, Rockhampton and Townsville will be able to compete for the funding, he said in a statement.

"The government believes it is time to put something back into the mining communities, and those communities which support them, that give so much to Australia and make our national economy strong," the statement said.

"That means more rail, roads, ports, and other crucial infrastructure to support the workforce in critical mining regions and in communities that support mining regions."

The announcement came as Mr Rudd met with miners and representatives from the Construction, Forestry, Mining, Energy Union at the Mackay Surf Club.

Earlier in the day, Mr Rudd was forced to hose down reports a compromise on the super-profits resource tax was imminent.

He said there was still "weeks and probably months" of consultation with Australia's big mining companies ahead for the government.

Comment was being sought from the Queensland government.

Monday, June 7, 2010

Q + A if an election was held today

http://www.reuters.com/article/idINSGE65602A20100607?rpc=44

read this article from Reuters today.

My thoughts are that if an election was held today, labor would lose. but it is all about preferences, and who holds the balance of power.

My Fear is that we will see many extreme groups (like HAMAS, and fanatical moslem groups)and individuals standing for the senate.

Lets hope I'm wrong.

read this article from Reuters today.

My thoughts are that if an election was held today, labor would lose. but it is all about preferences, and who holds the balance of power.

My Fear is that we will see many extreme groups (like HAMAS, and fanatical moslem groups)and individuals standing for the senate.

Lets hope I'm wrong.

Thursday, June 3, 2010

re more news from "the Australian" - Xstrata

article from the Australian today

KEVIN Rudd is refusing to budge on his super-profits tax after global miner Xstrata suspended $586 million worth of investment in Queensland yesterday, threatening 3250 jobs and triggering calls from Premier Anna Bligh and mining, business and union leaders to start genuine talks and compromise.

The sudden announcement to suspend further investment on the Wandoan thermal coal project and the Ernest Henry copper mine because of the fears over the resource super-profits tax dramatically increased the stakes in the tax war between the Rudd government and the miners because jobs are now at risk.

"Those people who got job termination notices today, this is no longer a war of words," Ms Bligh said yesterday. "This is causing real pain to Queensland families."

Xstrata yesterday cancelled 60 contract jobs after immediately suspending a $400m underground expansion of the Ernest Henry copper mine in northwest Queensland. It had planned to employ 190 people on the project. About $186m worth of work on the $6bn Wandoan mine and other coal projects in the centre of the state have also been suspended. Xstrata said the two projects would have created 3250 jobs, which were now "at risk".

Start of sidebar. Skip to end of sidebar.

Related CoverageTRADE: Minerals drive surplus

XSTRATA: Numbers don't add up for employees

HENRY ERGAS: Going retro with cash grab

IN DEPTH: Henry Tax Review

Rudd's claws out on mining tax Courier Mail, 1 hour ago

Rudd wrong on $6bn venture: Xstrata The Australian, 4 hours ago

Don't believe miners on tax, PM warns The Australian, 5 hours ago

Tax 'will cost Queensland $2.5bn' Courier Mail, 6 hours ago

Xstrata in warning over $6bn coal project Daily Telegraph, 8 hours ago

.End of sidebar. Return to start of sidebar.

Xstrata Coal chief executive Peter Freyberg said the decision was difficult. "This is devastating for the people involved, teams of people I have had working on it for several years - to have that all blown away as a result of a tax we have not seen, where the numbers and the models used is inappropriate for our industry is highly problematic," he said.

The mining sector is running a campaign against the tax and has delayed billions of dollars worth of projects. Yesterday's announcement was the first to directly affect mining jobs, although the tax is also affecting the value of mining companies listed on the stock exchange and held by investors, including superannuation funds.

One of the world's biggest resource fund managers revealed yesterday it had sold down a quarter of its BHP and Rio Tinto holdings because of the proposed tax.

JPMorgan Chase's Ian Henderson said Rio had been his biggest investment, about 4.5 per cent of the $US7 billion ($8.2bn) of resource assets under his control, but he had reduced his holding by about $US100 million. He also made a "reasonably significant" reduction in his holdings of iron ore miner Fortescue, but the JPMorgan funds had increased their stakes in goldminers.

"I'm sorry to say we've reduced our Australian exposure," Mr Henderson told Bloomberg. "I had not thought that the changes in Australia would be quite as drastic as they are proposed to be."

JPMorgan's chairman in Australia and New Zealand is Rod Eddington, a Rio director who this week added his voice to calls for the Prime Minister to restart negotiations with the industry.

Although Mr Rudd declared the government would not be pushed around by the industry, he said he was listening to calls for changes in negotiations for the tax. And Resources Minister Martin Ferguson said the mining companies and the government now agreed the debate was really about "how much tax is collected, how it's collected and who collects it".

Ms Bligh called for the Rudd government and miners to "get on with solving" the dispute over the 40 per cent tax on resource super profits. "I would urge both the federal government and the mining companies to get around the table, put down the baseball bats, stop the advertising and get on with solving it," she said. Australian Workers Union leader Paul Howes, whose union has funded advertising supporting the tax and attacking mining industry bosses, said last night Xstrata was a "good employer" but on this occasion, "I smell a rat and think they may have been led into an ideological argument". "It's a pretty ugly move and I don't believe it's because of the RSPT," Mr Howes said.

But he said it would be best for both sides to negotiate in "a cool and calm atmosphere".

"There's a case for everyone to take a step back and have some proper negotiations," he said.

Last night, Mr Freyberg slapped down the suggestion that suspension of the Queensland projects was a tactical ploy by the company in the mining industry's campaign against the tax. He said that after crunching the numbers on the tax, Xstrata had concluded that net profit from the new mine at Wandoan would fall from nearly $500m to "near zero".

Xstrata chief executive Mick Davis said the tax had "created significant uncertainty for the future of mining investment into Australia and would impair the value of previously approved projects and exploration to the point that continued investment can no longer be justified".

BHP Billiton chief executive Marius Kloppers also called last night for the government to change the terms of negotiations to avoid "massive unintended consequences" of the mining tax.

Infrastructure Australia head Rod Eddington, who advises the Prime Minister; the chairman of Qantas, Leigh Clifford; and the Business Council of Australia have also called on the government to enter serious negotiations on the new tax.

But Mr Rudd told parliament the government would not be bullied. "This government will not be intimidated by the statements of any mining company, foreign or domestic," he said, accusing the opposition of taking funding from the industry. "This government does not stand here as the puppet of parts of the mining industry, as those opposite do; this government stands here to act in the national interest on behalf of all Australians."

KEVIN Rudd is refusing to budge on his super-profits tax after global miner Xstrata suspended $586 million worth of investment in Queensland yesterday, threatening 3250 jobs and triggering calls from Premier Anna Bligh and mining, business and union leaders to start genuine talks and compromise.

The sudden announcement to suspend further investment on the Wandoan thermal coal project and the Ernest Henry copper mine because of the fears over the resource super-profits tax dramatically increased the stakes in the tax war between the Rudd government and the miners because jobs are now at risk.

"Those people who got job termination notices today, this is no longer a war of words," Ms Bligh said yesterday. "This is causing real pain to Queensland families."

Xstrata yesterday cancelled 60 contract jobs after immediately suspending a $400m underground expansion of the Ernest Henry copper mine in northwest Queensland. It had planned to employ 190 people on the project. About $186m worth of work on the $6bn Wandoan mine and other coal projects in the centre of the state have also been suspended. Xstrata said the two projects would have created 3250 jobs, which were now "at risk".

Start of sidebar. Skip to end of sidebar.

Related CoverageTRADE: Minerals drive surplus

XSTRATA: Numbers don't add up for employees

HENRY ERGAS: Going retro with cash grab

IN DEPTH: Henry Tax Review

Rudd's claws out on mining tax Courier Mail, 1 hour ago

Rudd wrong on $6bn venture: Xstrata The Australian, 4 hours ago

Don't believe miners on tax, PM warns The Australian, 5 hours ago

Tax 'will cost Queensland $2.5bn' Courier Mail, 6 hours ago

Xstrata in warning over $6bn coal project Daily Telegraph, 8 hours ago

.End of sidebar. Return to start of sidebar.

Xstrata Coal chief executive Peter Freyberg said the decision was difficult. "This is devastating for the people involved, teams of people I have had working on it for several years - to have that all blown away as a result of a tax we have not seen, where the numbers and the models used is inappropriate for our industry is highly problematic," he said.

The mining sector is running a campaign against the tax and has delayed billions of dollars worth of projects. Yesterday's announcement was the first to directly affect mining jobs, although the tax is also affecting the value of mining companies listed on the stock exchange and held by investors, including superannuation funds.

One of the world's biggest resource fund managers revealed yesterday it had sold down a quarter of its BHP and Rio Tinto holdings because of the proposed tax.

JPMorgan Chase's Ian Henderson said Rio had been his biggest investment, about 4.5 per cent of the $US7 billion ($8.2bn) of resource assets under his control, but he had reduced his holding by about $US100 million. He also made a "reasonably significant" reduction in his holdings of iron ore miner Fortescue, but the JPMorgan funds had increased their stakes in goldminers.

"I'm sorry to say we've reduced our Australian exposure," Mr Henderson told Bloomberg. "I had not thought that the changes in Australia would be quite as drastic as they are proposed to be."

JPMorgan's chairman in Australia and New Zealand is Rod Eddington, a Rio director who this week added his voice to calls for the Prime Minister to restart negotiations with the industry.

Although Mr Rudd declared the government would not be pushed around by the industry, he said he was listening to calls for changes in negotiations for the tax. And Resources Minister Martin Ferguson said the mining companies and the government now agreed the debate was really about "how much tax is collected, how it's collected and who collects it".

Ms Bligh called for the Rudd government and miners to "get on with solving" the dispute over the 40 per cent tax on resource super profits. "I would urge both the federal government and the mining companies to get around the table, put down the baseball bats, stop the advertising and get on with solving it," she said. Australian Workers Union leader Paul Howes, whose union has funded advertising supporting the tax and attacking mining industry bosses, said last night Xstrata was a "good employer" but on this occasion, "I smell a rat and think they may have been led into an ideological argument". "It's a pretty ugly move and I don't believe it's because of the RSPT," Mr Howes said.

But he said it would be best for both sides to negotiate in "a cool and calm atmosphere".

"There's a case for everyone to take a step back and have some proper negotiations," he said.

Last night, Mr Freyberg slapped down the suggestion that suspension of the Queensland projects was a tactical ploy by the company in the mining industry's campaign against the tax. He said that after crunching the numbers on the tax, Xstrata had concluded that net profit from the new mine at Wandoan would fall from nearly $500m to "near zero".

Xstrata chief executive Mick Davis said the tax had "created significant uncertainty for the future of mining investment into Australia and would impair the value of previously approved projects and exploration to the point that continued investment can no longer be justified".

BHP Billiton chief executive Marius Kloppers also called last night for the government to change the terms of negotiations to avoid "massive unintended consequences" of the mining tax.

Infrastructure Australia head Rod Eddington, who advises the Prime Minister; the chairman of Qantas, Leigh Clifford; and the Business Council of Australia have also called on the government to enter serious negotiations on the new tax.

But Mr Rudd told parliament the government would not be bullied. "This government will not be intimidated by the statements of any mining company, foreign or domestic," he said, accusing the opposition of taking funding from the industry. "This government does not stand here as the puppet of parts of the mining industry, as those opposite do; this government stands here to act in the national interest on behalf of all Australians."

Tuesday, June 1, 2010

news item list

Here are some news items 2nd may to 1st June 2010 ,regarding the RSPT.

The Resource Super Profits Tax | RSPT | mining | Federal Budget

11 May 2010 ... The Resource Super Profits Tax is a 40 per cent tax on mining profits, ... of 6 per cent from their existing earnings - called the RSPT allowance. .... they've lost the war · Downer shares plunge 27% on costs news ...

www.smh.com.au/.../the-resource-super-profits-tax--what-is-it-20100511-usnu.html

Mining super profits tax won't hit cost of living, says Treasury ...

Mining super profits tax won't hit cost of living, says Treasury boss Ken Henry. By staff writers; From: news.com.au; May 28, 2010 8:26AM ... And while mining executives have warned the RSPT would increase sovereign risk, ...

www.news.com.au/...rudd...mining-tax.../story-e6frfm1i-1225871830341Resource Super

Profits Tax 'to share mining wealth' | News.com.au

2 May 2010 ... Mining. The Federal Government has devised a Resource Super Profits Tax (RSPT) to give the public a share of resource profits more ...

www.news.com.au/...super-profits-tax...mining.../story-fn5dkrsb-1225861182878

Australia Introduces Super Profits Tax on Mining | Vanadium ...

25 May 2010 ... has proposed a Resource Super Profits Tax (RSPT) that will tax profits from ... By Desmond McMahon– Exclusive to Vanadium Investing News ...

vanadiuminvestingnews.com/.../australia-introduces-super-profits-tax-on-mining - CachedFactbox: the new mining tax - ABC News (Australian Broadcasting ...

25 May 2010 ... Super Profits Tax (RSPT) aims to reform taxation in the mining ... The ABC News Online Investigative Unit encourages whistleblowers, ...

www.abc.net.au/news/stories/2010/05/25/2908894.htm - CachedPeter Martin: Five easy pieces - the Mining Super Profits Tax

25 May 2010 ... "Without the RSPT mining companies and their largely foreign shareholders would ... It's not a tax, it applies to more than super profits, ... This is worth reading · This will make you want to watch the news -- Soooo. ...

petermartin.blogspot.com/.../five-easy-pieces-mining-super-profits.html -

CachedWayne Swan on Budget; Resource Super Profits Tax

Breaking News: Wayne Swan on Budget; Resource Super Profits Tax » Today's .... The third is that the RSPT applies to less of a mine's income than company ...

australia.to/.../index.php?...super-profits-tax...news... - CachedRudd's planned super profits tax gain economists' support ...

25 May 2010 ... The proposed 40 per cent resources super profits tax (RSPT) ... Rudd's planned super profits tax gain economists' support. Latest News in Economy ... that the RSPT is a more efficient way to tax the mining sector without ...

www.ibtimes.com/.../rspt-super-profits-tax-resources-super-profits-tax-allan-fels.htm - CachedRudd defends use of old tax data | Mining super profits tax | RSPT

25 May 2010 ... 25 May The federal government's super-profits tax will result in Chinese mining companies gobbling up Australian assets, Fortescue Metals ...

www.brisbanetimes.com.au/.../rudd-defends-use-of-old-tax-data-20100525-wa8s.htmlMining super profits tax: an economic perspective | University ...

1 Jun 2010 ... The RSPT is a 40% tax on all profits made above the 6% rate of ... Mining companies claim that defining “super-profits” at the 6% rate of ...

www.unisaustralia.com/.../mining-super-profits-tax-an-economic-perspective/ - 16 hours agoGet more results from the past 24 hours

The Resource Super Profits Tax | RSPT | mining | Federal Budget

11 May 2010 ... The Resource Super Profits Tax is a 40 per cent tax on mining profits, ... of 6 per cent from their existing earnings - called the RSPT allowance. .... they've lost the war · Downer shares plunge 27% on costs news ...

www.smh.com.au/.../the-resource-super-profits-tax--what-is-it-20100511-usnu.html

Mining super profits tax won't hit cost of living, says Treasury ...

Mining super profits tax won't hit cost of living, says Treasury boss Ken Henry. By staff writers; From: news.com.au; May 28, 2010 8:26AM ... And while mining executives have warned the RSPT would increase sovereign risk, ...

www.news.com.au/...rudd...mining-tax.../story-e6frfm1i-1225871830341Resource Super

Profits Tax 'to share mining wealth' | News.com.au

2 May 2010 ... Mining. The Federal Government has devised a Resource Super Profits Tax (RSPT) to give the public a share of resource profits more ...

www.news.com.au/...super-profits-tax...mining.../story-fn5dkrsb-1225861182878

Australia Introduces Super Profits Tax on Mining | Vanadium ...

25 May 2010 ... has proposed a Resource Super Profits Tax (RSPT) that will tax profits from ... By Desmond McMahon– Exclusive to Vanadium Investing News ...

vanadiuminvestingnews.com/.../australia-introduces-super-profits-tax-on-mining - CachedFactbox: the new mining tax - ABC News (Australian Broadcasting ...

25 May 2010 ... Super Profits Tax (RSPT) aims to reform taxation in the mining ... The ABC News Online Investigative Unit encourages whistleblowers, ...

www.abc.net.au/news/stories/2010/05/25/2908894.htm - CachedPeter Martin: Five easy pieces - the Mining Super Profits Tax

25 May 2010 ... "Without the RSPT mining companies and their largely foreign shareholders would ... It's not a tax, it applies to more than super profits, ... This is worth reading · This will make you want to watch the news -- Soooo. ...

petermartin.blogspot.com/.../five-easy-pieces-mining-super-profits.html -

CachedWayne Swan on Budget; Resource Super Profits Tax

Breaking News: Wayne Swan on Budget; Resource Super Profits Tax » Today's .... The third is that the RSPT applies to less of a mine's income than company ...

australia.to/.../index.php?...super-profits-tax...news... - CachedRudd's planned super profits tax gain economists' support ...

25 May 2010 ... The proposed 40 per cent resources super profits tax (RSPT) ... Rudd's planned super profits tax gain economists' support. Latest News in Economy ... that the RSPT is a more efficient way to tax the mining sector without ...

www.ibtimes.com/.../rspt-super-profits-tax-resources-super-profits-tax-allan-fels.htm - CachedRudd defends use of old tax data | Mining super profits tax | RSPT

25 May 2010 ... 25 May The federal government's super-profits tax will result in Chinese mining companies gobbling up Australian assets, Fortescue Metals ...

www.brisbanetimes.com.au/.../rudd-defends-use-of-old-tax-data-20100525-wa8s.htmlMining super profits tax: an economic perspective | University ...

1 Jun 2010 ... The RSPT is a 40% tax on all profits made above the 6% rate of ... Mining companies claim that defining “super-profits” at the 6% rate of ...

www.unisaustralia.com/.../mining-super-profits-tax-an-economic-perspective/ - 16 hours agoGet more results from the past 24 hours

Subscribe to:

Posts (Atom)