So is this how it will pan out. the old Divide and conquer, with miners taking the best option. read article below from the business speculator, especially last para..

It won't really matter much if there is an early election.

The tax will lead to a constitutional challenge and should win. it is against section 55 (i) and (ii) plus possibly other sections. This government, if re-elected will try to impose it on other sectors...

Let's not give in now.

Julia's choice on RSPTStephen Bartholomeusz

Published 4:05 PM, 29 Jun 2010

--------------------------------------------------------------------------------

It would appear that we’ll soon know whether Julia Gillard was genuine when she said she wanted to negotiate with the mining industry over the proposed resource super profits tax, or whether she’s simply following the political strategy Kevin Rudd was pursuing before he was so abruptly dumped.

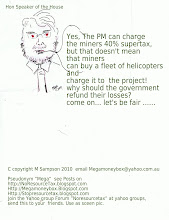

There are reports that Federal Cabinet is considering changes to the RSPT that would carve out the prospective coal seam gas-fed export LNG projects in Queensland, which would be covered by something akin to the existing petroleum resource rent tax. The RSPT could kill the projects and the planned tens-of-billions of investment in the new sector; under a PRRT they’d not pay a super tax on profits for probably the best part of a decade, if not more.

Changes to the super tax treatment of the CSG projects, or exclusion of low-value resources, or even smaller mines, would have minimal impact on the revenue collected from a RSPT, particularly if the government abandoned the tax credit for losses that no-one in the industry values or wants.

Therefore the government could appear to make very major concessions to the industry with minimal impact on the revenue the tax raises – indeed it might raise more than the $9 billion a year it is expected to generate without the transferable tax credit scheme.

Gillard could even raise the controversial uplift factor in the tax from the government bond rate of less than 6 per cent to the 11 per cent or so in the PRRT without making any real concession to the miners who will pay the overwhelming majority of the tax; the big mining houses with long-established mines and the iron ore and export-coal producers, in particular.

That would, however, be a highly political strategy – it was the strategy being developed by Kevin Rudd and Wayne Swan before Gillard displaced Rudd. It was designed to fragment the hitherto united industry opposition to the RSPT, isolating BHP Billiton, Rio Tinto, Xstrata and the other big miners and enabling the government to portray them as obdurate and greedy and absolutely committed to not paying a "fairer" share of tax.

The mining industry campaign would lose a lot of its potency if the industry’s solidarity was broken and it was being prosecuted only by a relative handful of the biggest players. A politically driven strategy would, however, also be a breach of Gillard’s promise to negotiate in good faith. The industry gave her the benefit of the doubt when it froze its campaign.

If she is genuine, and is genuinely concerned about the long-term best interests of the economy, rather than the short-term funding of Rudd and Swan’s planned pre-election spending spree – and the bigger miners appear to believe that she might be (while worrying about the influence of Swan and Treasury) – then the tax needs to be completely re-thought.

The headline rate of 40 per cent needs to be significantly reduced and the up-lift factor significantly increased and applied, not to the written-down book values of the mines, but to something approximating their current value to abandon the retrospectivity of the proposed tax. A re-thought tax also ought to discriminate between different types of resources and their different margin and capital expenditure profiles.

The Australian miners do compete in global markets and there is global competition for their capital. The long-term national interest dictates that any changes to the tax regime don’t undermine their competitiveness or divert capital to competing jurisdictions.

If Gillard includes the big miners in her negotiated responses to the exposed issues with the RSPT she will have demonstrated that she was being genuine when she identified the need to negotiate rather than consult with the industry as one of her earliest and most urgent priorities.

That might mean junking Swan’s budget strategy and the projected spending paid for by the tax; which won’t reflect well on Swan, but that’s a "price" worth paying to clear the way for a new tax on genuine super profits (rather than a super tax on normal profits) that doesn’t damage the sector and Australia’s reputation as a stable place for investment.

skip to main |

skip to sidebar

Julia's portrait for the PM Hall

Where in the B..Hell are you Johnny?

Twitter

We have to link together like an internet cobweb. The More spiders the better

What you can do besides writing to editors, politicians, and speaking up, is to become followers on as many blogs and forums and twitter sites which oppose the Resource Super profit Tax, as possible. If you forward information on the tax to as many people as possible, you will raise awareness. This tax is unconstitutional, and PRRT contains secrecy clauses, which means if you were a "whistleblower" you could be liable for $10,000 fine and or 2 years jail. Worse still, you could not present any documents relating to that company to the court.

When you become a follower, you help raise the status of the campaign. You can Email our cartoons, or pics. use them as screensavers and as an opportunity to raise the Supertax issue. Respect our efforts by adding our links, and giving credit for our volunteered work.

When you become a follower, you help raise the status of the campaign. You can Email our cartoons, or pics. use them as screensavers and as an opportunity to raise the Supertax issue. Respect our efforts by adding our links, and giving credit for our volunteered work.

Julia PM -barring all

Julia's portrait for the PM Hall

Welcome! to my Election Blog

This blog is written and authorised by NSW senate candidate Megan Sampson Wollongong (silent elector address)

My main election blog is at Http://megansampson.blogspot.com

you can email me at msmegansampson at gmail dot com

Get to know more..

see my other blogs at

Http://msmegansampson.blogspot.com

http://megamoneybox.blogspot.com

http://reduceyouruse.blogspot.com

http://cutcarbonuse.blogspot.com

http://www.permculturevisions.com

My main election blog is at Http://megansampson.blogspot.com

you can email me at msmegansampson at gmail dot com

Get to know more..

see my other blogs at

Http://msmegansampson.blogspot.com

http://megamoneybox.blogspot.com

http://reduceyouruse.blogspot.com

http://cutcarbonuse.blogspot.com

http://www.permculturevisions.com

Vote for Megan Sampson in NSW senate.Col K.

Make your own solar panels!

All the grannies want Little Johnny Howard back

Where in the B..Hell are you Johnny?

Join the Noreourcetax forum at Yahoo

Flinders ranges. Our art is for sale. suport the campaign

Share market tips and our blogs

Followers

Blog Archive

-

▼

2010

(36)

-

▼

June

(16)

- so now the greens want the RSPT.. anything for lab...

- Is this how it will pan out? divide and conquer?

- Don't cave in.. the election is nigh. RSPT must be...

- twiggy didnt cave in.. and Gillard gets top job.

- so is this the answer??

- australia -chinese deal announced today?!?

- What does twiggy know taht we don't?

- The PM. 1+ 1 = 1000, or a 1,000,000 The multiplier...

- the battle continues.

- the bigger picture

- BHP slams RSPT

- don't get sucked in...

- Don't get sucked in, with promises see the legisla...

- Q + A if an election was held today

- re more news from "the Australian" - Xstrata

- news item list

-

▼

June

(16)