> SYDNEY, May 27 (Reuters) - Australia's government may be considering

> changes to its controversial new mining tax, which critics argue will hit

> economic growth and supporters say will ensure miners pay a fair price for

> limited national resources.

>

> Treasurer Wayne Swan, after weeks of public and private debate, has so far

> said he will proceed with the original "tax framework" to take effect in

> 2012, but details of the tax are subject to negotiation and could be

> tweaked.

>

> * WHAT'S CHANGED SINCE THE MAY UNVEILING OF THE TAX?

>

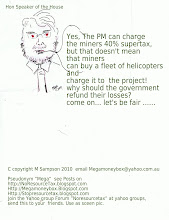

> Prime Minister Kevin Rudd has said the 40 percent tax rate is set in stone

> and will not give ground here for fear of damaging his authority in the

> lead-up to elections later this year. But The Australian and The Sydney

> Morning Herald newspapers reported on Thursday that Rudd's Labor party is

> moving to soften the blow by redefining a windfall or "super" profit to

> returns on assets exceeding 12 percent, up from 5.3 percent now.

> [ID:nSGE64P0M8]

>

> The 5.3 percent threshold-- linked to the the 10-year government bond

> yield AU10YT=RR -- is a key gripe among the miners, who think it is

> unrealistically low.

>

> A Treasury-sanctioned tax consultation panel is due to deliver its first

> report to the government on Friday after meeting over the last week with

> mining companies. The panel's report is expected to focus on the

> definition of a super profit.

>

> The tax is not due to be introduced until 2012, after the next general

> election, so there is even a chance the government will be voted out

> before it can implement it. [ID:nSGE64J02A]

>

> WHAT ARE THE POSSIBLE POINTS OF COMPROMISE?

>

> The least likely point of compromise seems to be the headline rate of 40

> percent. But even here, Rudd has some wiggle room, describing the headline

> rate as "about right".

>

> Beyond that, there are aspects of the complex tax which, if changed, could

> dramatically lower its impact.

>

> * EXISTING VS FUTURE PROJECTS: Australia's two largest miners, Rio Tinto

> RIO.AX <RIO.L and BHP Billiton (BHP.AX) (BLT.L), have called on the

> government to exclude existing mining operations and apply the tax only to

> projects beginning after 2012. The government says such exclusions would

> forfeit too much revenue and discourage miners from expanding.

>

> Miners can still look to offsetting tax credits for exploration and

> development costs, resulting in a lower effective tax rate than 40

> percent. But what about all the hundreds of billions of dollars already

> sunk into existing projects? Will the government award retrospective tax

> credits for these?

>

> The architect of the tax, Treasury chief Ken Henry, has argued against

> this. But miners have support from some economists who suggest a credit

> for 40 percent of original investments. However, a group of 20 prominent

> academic and business economists has publicly backed the tax, saying the

> sector should fork over more of its profits. The group, including the

> former chairman of the Australian Competition and Consumer Commission,

> Allan Fels, issued a statement supporting the tax.

>

> * FINANCING COSTS: Iron ore miner Fortescue Metals Group Chief Executive

> Andrew Forrest (FMG.AX) says unlike company tax, the new mining tax will

> hit firms higher up the profit statement, before deducting interest on

> borrowings. This means banks will not fund new projects unless businesses

> stump up more equity.

>

> Playing the nationalist card, Forrest says this opens the door to

> deep-pocketed foreign firms, especially state-owned Chinese ones, to buy

> up stakes in new Australian projects. A compromise could involve financing

> costs being excluded from calculations.

>

> * WILL THE GOVERNMENT BACK DOWN ON THE TAX?

>

> Rudd will not reverse course on the tax, despite conservative opposition

> threats to overturn it if they secure an unexpected victory. But with

> Rudd's support in opinion polls slipping dangerously and the tax causing

> unease among voters, fuelled in part by a multi-million-dollar advertising

> campaign by miners, a compromise to cool the issue politically seems

> certain.

>

> It is a matter of finding a face-saving solution for Rudd that keeps the

> resource giants on side.

>

> Even if negotiations break down, there is one last hope for the miners: a

> legal challenge. The largest mining state, Western Australia, is

> consulting its lawyers over whether the tax exceeds Canberra's powers

> under the national constitution, which forbids the centre from taxing the

> property of state governments. Two constitutional experts cast doubt,

> however, on whether there would be grounds for a legal challenge.

> [ID:nSYU009974] (Additional reporting by Rob Taylor in CANBERRA; Editing

> by Ed Davies)

>

>

>

Thursday, May 27, 2010

Fw: change or no change?

Subject: change or no change?