here's part of a comment on this ref page...

"steelerudd of coolie Posted at 12:47 PM Today

Angela Evans of Brisbane Posted at 11:59 AM Today Couple of points. The GST arrangements are a Commonwealth tax and a simple agreement to distribute the proceeds to the states according to the HFE relativities. The states have no right to the revenue - it is a gift from the Commonwealth which the Commonwealth can alter by simply changing the intergovernmental agreement and the GST tax legislation. No ifs, buts or maybes - Barnett is completely wrong and will lose his 30% once the legislation is passed and Gillard tires of his grandstanding. Wrong on so many points that I can,t even be bothered to point out your non factual parts , as for Joolya / Swan getting any thing past their master (B.Brown ) I,d Like To See That. MS So that's how they will get around the constitutional challenge? its a gift not a right?

here's the article

A NEW battle over the mineral resources rent tax is looming as Western Australia and Queensland push for the regional infrastructure fund promised as a sweetener to be excluded from the system for carving up more than $50 billion in GST receipts.

West Australian bureaucrats fear the state will be short-changed and have insisted the fund be quarantined from the Commonwealth Grants Commission process that siphons GST and other revenue from the rich states to the poorer ones.

The Queensland Labor government also insists that its share of the new fund must not be reduced because of the GST formula.

When Wayne Swan announced the Regional Infrastructure Fund -- to be funded with the proceeds of the then resource super-profits tax -- he said the "lion's share" should go to the mining states of WA and Queensland to fund rail, roads, ports and other crucial infrastructure.

But putting the cash -- an initial $700 million and up to $6bn over the next decade -- into the grants commission process for allocating the GST pool could reduce the amount received by WA and Queensland in favour of poorer states such as South Australia and Tasmania.

Start of sidebar. Skip to end of sidebar.

Related Coverage

EDITORIAL: Tax reform must head the agenda

End of sidebar. Return to start of sidebar.

The push threatens to add to the row between the Gillard government and the states over the MRRT, which replaced the RSPT in July. Canberra is already threatening to penalise states that increase their mining royalties in the future after a damaging stoush over whether miners would get a credit against federal taxes for hikes in state royalties.

West Australian Premier Colin Barnett said he remained vehemently opposed to the MRRT and the Regional Infrastructure Fund "doesn't win over our support for it at all".

"Julia Gillard keeps on talking about $2bn for Western Australia. I think it's over 10 years. It's not a large amount of money. You're talking about $200m a year. That won't build much."

While the Premier is focused on scuttling the MRRT, the WA Department of Treasury and Finance has pushed for the money to be quarantined from the grants commission process. It has outlined its position in a paper handed to a Senate committee inquiring into the mining tax.

Because the grants commission's formula for distributing the GST works by redistributing revenue windfalls -- including some federal payments -- between the states, the mining states stand to be punished if the infrastructure fund is not excluded from that process.

Queensland's Treasurer, Andrew Fraser, said it was crucial to ensure that his state was "not short-changed" because of "any unintended consequence" of the grants commission formula.

"We believe the federal government will honour its commitment to ensure the states that contribute to the mining boom get the lion's share of the infrastructure funds," Mr Fraser said. "This fund has been dedicated to meeting the infrastructure task in mining states and we won't accept moves by other states to claw back the funds."

WA is already refusing to hand over a third of the state's GST as part of the federal health takeover and new Victorian Premier, Ted Baillieu, has also threatened to resist the deal. Mr Barnett said the commonwealth could not "unilaterally, or even with majority state support, change the GST formulas".

As well as inflaming federal-state tensions, the stance being taken by the resource-rich states over the treatment of the infrastructure fund is reviving bickering between the states over the GST carve-up.

NSW Treasurer Eric Roozendaal hit back at WA and Queensland, accusing them of acting like the "Bonnie and Clyde of the Australian federation". "Enough is enough. It is time that the developing economies of Western Australia and Queensland were held to account for squandering the resources boom," he said.

While there was a strong case to help small states like the Northern Territory that needed to provide services to isolated Aboriginal communities, NSW had cross-subsidised WA and Queensland to the tune of $1bn over the past 10 years, he said.

But Mr Fraser said the non-mining states already reaped a "huge benefit" from royalties redistributed by the grants commission. While Canberra and the states agreed to the process for distributing GST in an inter-governmental agreement, the commonwealth has the scope to decide matters like quarantining of payments.

The government has not yet provided the terms of reference to the grants commission for its 2011 review of the distribution of GST money. Mr Swan's office said the government would work with the states and territories on the arrangements for the distribution of the Regional Infrastructure Fund. If federal payments are not specifically quarantined from the GST carve-up by the commonwealth, the grants commission typically decides whether they should be included. For example, if the money is paid to a third party and it has no impact on a state's budgetary capacity, it could decide to exclude it.

ref http://www.theaustralian.com.au/national-affairs/states-flag-new-mining-tax-row/story-fn59niix-1225980692715?referrer=email&source=Punch_nl&emcmp=Punch&emchn=Newsletter&emlist=Member

ref article http://www.theaustralian.com.au/national-affairs/states-flag-new-mining-tax-row/story-fn59niix-1225980692715?referrer=email&source=Punch_nl&emcmp=Punch&emchn=Newsletter&emlist=Member

skip to main |

skip to sidebar

Julia's portrait for the PM Hall

Where in the B..Hell are you Johnny?

Twitter

We have to link together like an internet cobweb. The More spiders the better

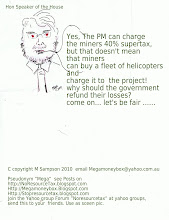

What you can do besides writing to editors, politicians, and speaking up, is to become followers on as many blogs and forums and twitter sites which oppose the Resource Super profit Tax, as possible. If you forward information on the tax to as many people as possible, you will raise awareness. This tax is unconstitutional, and PRRT contains secrecy clauses, which means if you were a "whistleblower" you could be liable for $10,000 fine and or 2 years jail. Worse still, you could not present any documents relating to that company to the court.

When you become a follower, you help raise the status of the campaign. You can Email our cartoons, or pics. use them as screensavers and as an opportunity to raise the Supertax issue. Respect our efforts by adding our links, and giving credit for our volunteered work.

When you become a follower, you help raise the status of the campaign. You can Email our cartoons, or pics. use them as screensavers and as an opportunity to raise the Supertax issue. Respect our efforts by adding our links, and giving credit for our volunteered work.

Julia PM -barring all

Julia's portrait for the PM Hall

Welcome! to my Election Blog

This blog is written and authorised by NSW senate candidate Megan Sampson Wollongong (silent elector address)

My main election blog is at Http://megansampson.blogspot.com

you can email me at msmegansampson at gmail dot com

Get to know more..

see my other blogs at

Http://msmegansampson.blogspot.com

http://megamoneybox.blogspot.com

http://reduceyouruse.blogspot.com

http://cutcarbonuse.blogspot.com

http://www.permculturevisions.com

My main election blog is at Http://megansampson.blogspot.com

you can email me at msmegansampson at gmail dot com

Get to know more..

see my other blogs at

Http://msmegansampson.blogspot.com

http://megamoneybox.blogspot.com

http://reduceyouruse.blogspot.com

http://cutcarbonuse.blogspot.com

http://www.permculturevisions.com

Vote for Megan Sampson in NSW senate.Col K.

Make your own solar panels!

All the grannies want Little Johnny Howard back

Where in the B..Hell are you Johnny?