Rudd announces chemists cSPT? (Chemist super profits tax)

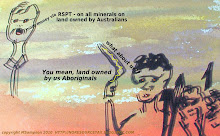

We might need to tax the foreign comapnies who have made deals with aboriginal groups, and who are not on the asx, but to become a joint partner and subsidise losses via the taxpayer is ridiculous. To tax a company 40% above the bond rate (say 6%)is socialism. There's been no legislation put up, no real discussion and what industry will be next? Mega from http://noresourcetax.blogspot.com says Beware for our future.

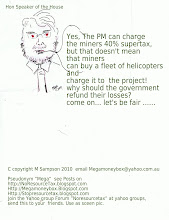

Why not a chemist supertax? they make money from already taxpayer funded doctors prescriptions.. or pathologists..they make money from taxpayers and bleed the govt dry! Rudd imposed a RSPT while reducing company tax from 30% to 28%? He gives in one hand, takes away in the other..

Sunday, June 13, 2010

Friday, June 11, 2010

BHP slams RSPT

ref http://www.proactiveinvestors.co.uk/companies/news/17568/bhp-billiton-chairman-jac-nasser-slams-australian-mining-super-tax-17568.html

Friday, June 11, 2010 by Jamie Ashcroft

BHP noted its disappointment that such a consultation has not been possible in relation to the ‘super-tax’. “Therefore the government missed the opportunity to have Treasury's theory tested by practical experience and industry knowledge”, Nasser stated.

“We always welcome the opportunity to consult but unfortunately ... there has been no acknowledgement by the government of the major flaws of the proposed tax and the significant impact on the industry”. BHP said it is not against tax reform, but it believes that the principles of sound tax reform are not present in the current proposal.

“The 40 per cent super tax rate, in addition to company tax, will make the Australian mineral resources industry the highest taxed in the world and uncompetitive with other resource-rich nations. An uncompetitive tax rate is a fundamental problem.”

“The super tax will apply to existing projects, fundamentally changing the rules when billions of dollars have already been invested.”

According to BHP, any new tax on the minerals resources industry should: Not fundamentally change the rules of the game on existing projects; Ensure that overall tax is competitive with other mineral resources countries; Vary between the kind of mineral resources mined; Be applied on the value of minerals alone.

Otherwise, the company believes that the proposal could damage Australia's reputation as a stable and fair place for investment, the country could lose investment to countries with more attractive tax rates, and it could unintentionally penalise investments in infrastructure, processing or other support activities.

“The Australian government needs to understand the real world impact of the proposed super tax or it will hurt the Australian minerals industry and hurt Australia's future,” Nasser said.

BHP also told its shareholders that it wanted to set the record straight, in terms of its own tax payments in Australia. “The government has not accurately represented the level of taxes we pay on our Australian operations ... It concerns BHP Billiton that inappropriate conclusions appear to have been drawn ... Total taxes paid by BHP Billiton's Australian operations in relation to the financial years 2004 to 2009 inclusive exceed A$24 billion."

“The 2009 earnings of BHP Billiton's Australian operations were almost fully reinvested back in Australia,” he added

Friday, June 11, 2010 by Jamie Ashcroft

BHP noted its disappointment that such a consultation has not been possible in relation to the ‘super-tax’. “Therefore the government missed the opportunity to have Treasury's theory tested by practical experience and industry knowledge”, Nasser stated.

“We always welcome the opportunity to consult but unfortunately ... there has been no acknowledgement by the government of the major flaws of the proposed tax and the significant impact on the industry”. BHP said it is not against tax reform, but it believes that the principles of sound tax reform are not present in the current proposal.

“The 40 per cent super tax rate, in addition to company tax, will make the Australian mineral resources industry the highest taxed in the world and uncompetitive with other resource-rich nations. An uncompetitive tax rate is a fundamental problem.”

“The super tax will apply to existing projects, fundamentally changing the rules when billions of dollars have already been invested.”

According to BHP, any new tax on the minerals resources industry should: Not fundamentally change the rules of the game on existing projects; Ensure that overall tax is competitive with other mineral resources countries; Vary between the kind of mineral resources mined; Be applied on the value of minerals alone.

Otherwise, the company believes that the proposal could damage Australia's reputation as a stable and fair place for investment, the country could lose investment to countries with more attractive tax rates, and it could unintentionally penalise investments in infrastructure, processing or other support activities.

“The Australian government needs to understand the real world impact of the proposed super tax or it will hurt the Australian minerals industry and hurt Australia's future,” Nasser said.

BHP also told its shareholders that it wanted to set the record straight, in terms of its own tax payments in Australia. “The government has not accurately represented the level of taxes we pay on our Australian operations ... It concerns BHP Billiton that inappropriate conclusions appear to have been drawn ... Total taxes paid by BHP Billiton's Australian operations in relation to the financial years 2004 to 2009 inclusive exceed A$24 billion."

“The 2009 earnings of BHP Billiton's Australian operations were almost fully reinvested back in Australia,” he added

Thursday, June 10, 2010

don't get sucked in...

The AWU Paul Howes is mobilising supporters. NSW/Illawarra miners to support the government..

and todays news article

http://au.news.yahoo.com/a/-/latest/7384405/pm-promises-billions-for-infrastructure/

Prime Minister Kevin Rudd has promised more than $2 billion in infrastructure funding for Queensland as he continues the hard-sell of his mining tax.

Queensland and Western Australia are each getting more than $2 billion for infrastructure under a new $6 billion regional infrastructure fund, using proceeds from the super-profits tax.

Mr Rudd on Friday confirmed Queensland could expect a $2 billion boost from the fund.

The state's mining centres such as Mackay, Gladstone, Rockhampton and Townsville will be able to compete for the funding, he said in a statement.

"The government believes it is time to put something back into the mining communities, and those communities which support them, that give so much to Australia and make our national economy strong," the statement said.

"That means more rail, roads, ports, and other crucial infrastructure to support the workforce in critical mining regions and in communities that support mining regions."

The announcement came as Mr Rudd met with miners and representatives from the Construction, Forestry, Mining, Energy Union at the Mackay Surf Club.

Earlier in the day, Mr Rudd was forced to hose down reports a compromise on the super-profits resource tax was imminent.

He said there was still "weeks and probably months" of consultation with Australia's big mining companies ahead for the government.

Comment was being sought from the Queensland government.

and todays news article

http://au.news.yahoo.com/a/-/latest/7384405/pm-promises-billions-for-infrastructure/

Prime Minister Kevin Rudd has promised more than $2 billion in infrastructure funding for Queensland as he continues the hard-sell of his mining tax.

Queensland and Western Australia are each getting more than $2 billion for infrastructure under a new $6 billion regional infrastructure fund, using proceeds from the super-profits tax.

Mr Rudd on Friday confirmed Queensland could expect a $2 billion boost from the fund.

The state's mining centres such as Mackay, Gladstone, Rockhampton and Townsville will be able to compete for the funding, he said in a statement.

"The government believes it is time to put something back into the mining communities, and those communities which support them, that give so much to Australia and make our national economy strong," the statement said.

"That means more rail, roads, ports, and other crucial infrastructure to support the workforce in critical mining regions and in communities that support mining regions."

The announcement came as Mr Rudd met with miners and representatives from the Construction, Forestry, Mining, Energy Union at the Mackay Surf Club.

Earlier in the day, Mr Rudd was forced to hose down reports a compromise on the super-profits resource tax was imminent.

He said there was still "weeks and probably months" of consultation with Australia's big mining companies ahead for the government.

Comment was being sought from the Queensland government.

Don't get sucked in, with promises see the legislation

http://au.news.yahoo.com/a/-/latest/7384405/pm-promises-billions-for-infrastructure/

Prime Minister Kevin Rudd has promised more than $2 billion in infrastructure funding for Queensland as he continues the hard-sell of his mining tax.

Queensland and Western Australia are each getting more than $2 billion for infrastructure under a new $6 billion regional infrastructure fund, using proceeds from the super-profits tax.

Mr Rudd on Friday confirmed Queensland could expect a $2 billion boost from the fund.

The state's mining centres such as Mackay, Gladstone, Rockhampton and Townsville will be able to compete for the funding, he said in a statement.

"The government believes it is time to put something back into the mining communities, and those communities which support them, that give so much to Australia and make our national economy strong," the statement said.

"That means more rail, roads, ports, and other crucial infrastructure to support the workforce in critical mining regions and in communities that support mining regions."

The announcement came as Mr Rudd met with miners and representatives from the Construction, Forestry, Mining, Energy Union at the Mackay Surf Club.

Earlier in the day, Mr Rudd was forced to hose down reports a compromise on the super-profits resource tax was imminent.

He said there was still "weeks and probably months" of consultation with Australia's big mining companies ahead for the government.

Comment was being sought from the Queensland government.

Prime Minister Kevin Rudd has promised more than $2 billion in infrastructure funding for Queensland as he continues the hard-sell of his mining tax.

Queensland and Western Australia are each getting more than $2 billion for infrastructure under a new $6 billion regional infrastructure fund, using proceeds from the super-profits tax.

Mr Rudd on Friday confirmed Queensland could expect a $2 billion boost from the fund.

The state's mining centres such as Mackay, Gladstone, Rockhampton and Townsville will be able to compete for the funding, he said in a statement.

"The government believes it is time to put something back into the mining communities, and those communities which support them, that give so much to Australia and make our national economy strong," the statement said.

"That means more rail, roads, ports, and other crucial infrastructure to support the workforce in critical mining regions and in communities that support mining regions."

The announcement came as Mr Rudd met with miners and representatives from the Construction, Forestry, Mining, Energy Union at the Mackay Surf Club.

Earlier in the day, Mr Rudd was forced to hose down reports a compromise on the super-profits resource tax was imminent.

He said there was still "weeks and probably months" of consultation with Australia's big mining companies ahead for the government.

Comment was being sought from the Queensland government.

Monday, June 7, 2010

Q + A if an election was held today

http://www.reuters.com/article/idINSGE65602A20100607?rpc=44

read this article from Reuters today.

My thoughts are that if an election was held today, labor would lose. but it is all about preferences, and who holds the balance of power.

My Fear is that we will see many extreme groups (like HAMAS, and fanatical moslem groups)and individuals standing for the senate.

Lets hope I'm wrong.

read this article from Reuters today.

My thoughts are that if an election was held today, labor would lose. but it is all about preferences, and who holds the balance of power.

My Fear is that we will see many extreme groups (like HAMAS, and fanatical moslem groups)and individuals standing for the senate.

Lets hope I'm wrong.

Thursday, June 3, 2010

re more news from "the Australian" - Xstrata

article from the Australian today

KEVIN Rudd is refusing to budge on his super-profits tax after global miner Xstrata suspended $586 million worth of investment in Queensland yesterday, threatening 3250 jobs and triggering calls from Premier Anna Bligh and mining, business and union leaders to start genuine talks and compromise.

The sudden announcement to suspend further investment on the Wandoan thermal coal project and the Ernest Henry copper mine because of the fears over the resource super-profits tax dramatically increased the stakes in the tax war between the Rudd government and the miners because jobs are now at risk.

"Those people who got job termination notices today, this is no longer a war of words," Ms Bligh said yesterday. "This is causing real pain to Queensland families."

Xstrata yesterday cancelled 60 contract jobs after immediately suspending a $400m underground expansion of the Ernest Henry copper mine in northwest Queensland. It had planned to employ 190 people on the project. About $186m worth of work on the $6bn Wandoan mine and other coal projects in the centre of the state have also been suspended. Xstrata said the two projects would have created 3250 jobs, which were now "at risk".

Start of sidebar. Skip to end of sidebar.

Related CoverageTRADE: Minerals drive surplus

XSTRATA: Numbers don't add up for employees

HENRY ERGAS: Going retro with cash grab

IN DEPTH: Henry Tax Review

Rudd's claws out on mining tax Courier Mail, 1 hour ago

Rudd wrong on $6bn venture: Xstrata The Australian, 4 hours ago

Don't believe miners on tax, PM warns The Australian, 5 hours ago

Tax 'will cost Queensland $2.5bn' Courier Mail, 6 hours ago

Xstrata in warning over $6bn coal project Daily Telegraph, 8 hours ago

.End of sidebar. Return to start of sidebar.

Xstrata Coal chief executive Peter Freyberg said the decision was difficult. "This is devastating for the people involved, teams of people I have had working on it for several years - to have that all blown away as a result of a tax we have not seen, where the numbers and the models used is inappropriate for our industry is highly problematic," he said.

The mining sector is running a campaign against the tax and has delayed billions of dollars worth of projects. Yesterday's announcement was the first to directly affect mining jobs, although the tax is also affecting the value of mining companies listed on the stock exchange and held by investors, including superannuation funds.

One of the world's biggest resource fund managers revealed yesterday it had sold down a quarter of its BHP and Rio Tinto holdings because of the proposed tax.

JPMorgan Chase's Ian Henderson said Rio had been his biggest investment, about 4.5 per cent of the $US7 billion ($8.2bn) of resource assets under his control, but he had reduced his holding by about $US100 million. He also made a "reasonably significant" reduction in his holdings of iron ore miner Fortescue, but the JPMorgan funds had increased their stakes in goldminers.

"I'm sorry to say we've reduced our Australian exposure," Mr Henderson told Bloomberg. "I had not thought that the changes in Australia would be quite as drastic as they are proposed to be."

JPMorgan's chairman in Australia and New Zealand is Rod Eddington, a Rio director who this week added his voice to calls for the Prime Minister to restart negotiations with the industry.

Although Mr Rudd declared the government would not be pushed around by the industry, he said he was listening to calls for changes in negotiations for the tax. And Resources Minister Martin Ferguson said the mining companies and the government now agreed the debate was really about "how much tax is collected, how it's collected and who collects it".

Ms Bligh called for the Rudd government and miners to "get on with solving" the dispute over the 40 per cent tax on resource super profits. "I would urge both the federal government and the mining companies to get around the table, put down the baseball bats, stop the advertising and get on with solving it," she said. Australian Workers Union leader Paul Howes, whose union has funded advertising supporting the tax and attacking mining industry bosses, said last night Xstrata was a "good employer" but on this occasion, "I smell a rat and think they may have been led into an ideological argument". "It's a pretty ugly move and I don't believe it's because of the RSPT," Mr Howes said.

But he said it would be best for both sides to negotiate in "a cool and calm atmosphere".

"There's a case for everyone to take a step back and have some proper negotiations," he said.

Last night, Mr Freyberg slapped down the suggestion that suspension of the Queensland projects was a tactical ploy by the company in the mining industry's campaign against the tax. He said that after crunching the numbers on the tax, Xstrata had concluded that net profit from the new mine at Wandoan would fall from nearly $500m to "near zero".

Xstrata chief executive Mick Davis said the tax had "created significant uncertainty for the future of mining investment into Australia and would impair the value of previously approved projects and exploration to the point that continued investment can no longer be justified".

BHP Billiton chief executive Marius Kloppers also called last night for the government to change the terms of negotiations to avoid "massive unintended consequences" of the mining tax.

Infrastructure Australia head Rod Eddington, who advises the Prime Minister; the chairman of Qantas, Leigh Clifford; and the Business Council of Australia have also called on the government to enter serious negotiations on the new tax.

But Mr Rudd told parliament the government would not be bullied. "This government will not be intimidated by the statements of any mining company, foreign or domestic," he said, accusing the opposition of taking funding from the industry. "This government does not stand here as the puppet of parts of the mining industry, as those opposite do; this government stands here to act in the national interest on behalf of all Australians."

KEVIN Rudd is refusing to budge on his super-profits tax after global miner Xstrata suspended $586 million worth of investment in Queensland yesterday, threatening 3250 jobs and triggering calls from Premier Anna Bligh and mining, business and union leaders to start genuine talks and compromise.

The sudden announcement to suspend further investment on the Wandoan thermal coal project and the Ernest Henry copper mine because of the fears over the resource super-profits tax dramatically increased the stakes in the tax war between the Rudd government and the miners because jobs are now at risk.

"Those people who got job termination notices today, this is no longer a war of words," Ms Bligh said yesterday. "This is causing real pain to Queensland families."

Xstrata yesterday cancelled 60 contract jobs after immediately suspending a $400m underground expansion of the Ernest Henry copper mine in northwest Queensland. It had planned to employ 190 people on the project. About $186m worth of work on the $6bn Wandoan mine and other coal projects in the centre of the state have also been suspended. Xstrata said the two projects would have created 3250 jobs, which were now "at risk".

Start of sidebar. Skip to end of sidebar.

Related CoverageTRADE: Minerals drive surplus

XSTRATA: Numbers don't add up for employees

HENRY ERGAS: Going retro with cash grab

IN DEPTH: Henry Tax Review

Rudd's claws out on mining tax Courier Mail, 1 hour ago

Rudd wrong on $6bn venture: Xstrata The Australian, 4 hours ago

Don't believe miners on tax, PM warns The Australian, 5 hours ago

Tax 'will cost Queensland $2.5bn' Courier Mail, 6 hours ago

Xstrata in warning over $6bn coal project Daily Telegraph, 8 hours ago

.End of sidebar. Return to start of sidebar.

Xstrata Coal chief executive Peter Freyberg said the decision was difficult. "This is devastating for the people involved, teams of people I have had working on it for several years - to have that all blown away as a result of a tax we have not seen, where the numbers and the models used is inappropriate for our industry is highly problematic," he said.

The mining sector is running a campaign against the tax and has delayed billions of dollars worth of projects. Yesterday's announcement was the first to directly affect mining jobs, although the tax is also affecting the value of mining companies listed on the stock exchange and held by investors, including superannuation funds.

One of the world's biggest resource fund managers revealed yesterday it had sold down a quarter of its BHP and Rio Tinto holdings because of the proposed tax.

JPMorgan Chase's Ian Henderson said Rio had been his biggest investment, about 4.5 per cent of the $US7 billion ($8.2bn) of resource assets under his control, but he had reduced his holding by about $US100 million. He also made a "reasonably significant" reduction in his holdings of iron ore miner Fortescue, but the JPMorgan funds had increased their stakes in goldminers.

"I'm sorry to say we've reduced our Australian exposure," Mr Henderson told Bloomberg. "I had not thought that the changes in Australia would be quite as drastic as they are proposed to be."

JPMorgan's chairman in Australia and New Zealand is Rod Eddington, a Rio director who this week added his voice to calls for the Prime Minister to restart negotiations with the industry.

Although Mr Rudd declared the government would not be pushed around by the industry, he said he was listening to calls for changes in negotiations for the tax. And Resources Minister Martin Ferguson said the mining companies and the government now agreed the debate was really about "how much tax is collected, how it's collected and who collects it".

Ms Bligh called for the Rudd government and miners to "get on with solving" the dispute over the 40 per cent tax on resource super profits. "I would urge both the federal government and the mining companies to get around the table, put down the baseball bats, stop the advertising and get on with solving it," she said. Australian Workers Union leader Paul Howes, whose union has funded advertising supporting the tax and attacking mining industry bosses, said last night Xstrata was a "good employer" but on this occasion, "I smell a rat and think they may have been led into an ideological argument". "It's a pretty ugly move and I don't believe it's because of the RSPT," Mr Howes said.

But he said it would be best for both sides to negotiate in "a cool and calm atmosphere".

"There's a case for everyone to take a step back and have some proper negotiations," he said.

Last night, Mr Freyberg slapped down the suggestion that suspension of the Queensland projects was a tactical ploy by the company in the mining industry's campaign against the tax. He said that after crunching the numbers on the tax, Xstrata had concluded that net profit from the new mine at Wandoan would fall from nearly $500m to "near zero".

Xstrata chief executive Mick Davis said the tax had "created significant uncertainty for the future of mining investment into Australia and would impair the value of previously approved projects and exploration to the point that continued investment can no longer be justified".

BHP Billiton chief executive Marius Kloppers also called last night for the government to change the terms of negotiations to avoid "massive unintended consequences" of the mining tax.

Infrastructure Australia head Rod Eddington, who advises the Prime Minister; the chairman of Qantas, Leigh Clifford; and the Business Council of Australia have also called on the government to enter serious negotiations on the new tax.

But Mr Rudd told parliament the government would not be bullied. "This government will not be intimidated by the statements of any mining company, foreign or domestic," he said, accusing the opposition of taking funding from the industry. "This government does not stand here as the puppet of parts of the mining industry, as those opposite do; this government stands here to act in the national interest on behalf of all Australians."

Tuesday, June 1, 2010

news item list

Here are some news items 2nd may to 1st June 2010 ,regarding the RSPT.

The Resource Super Profits Tax | RSPT | mining | Federal Budget

11 May 2010 ... The Resource Super Profits Tax is a 40 per cent tax on mining profits, ... of 6 per cent from their existing earnings - called the RSPT allowance. .... they've lost the war · Downer shares plunge 27% on costs news ...

www.smh.com.au/.../the-resource-super-profits-tax--what-is-it-20100511-usnu.html

Mining super profits tax won't hit cost of living, says Treasury ...

Mining super profits tax won't hit cost of living, says Treasury boss Ken Henry. By staff writers; From: news.com.au; May 28, 2010 8:26AM ... And while mining executives have warned the RSPT would increase sovereign risk, ...

www.news.com.au/...rudd...mining-tax.../story-e6frfm1i-1225871830341Resource Super

Profits Tax 'to share mining wealth' | News.com.au

2 May 2010 ... Mining. The Federal Government has devised a Resource Super Profits Tax (RSPT) to give the public a share of resource profits more ...

www.news.com.au/...super-profits-tax...mining.../story-fn5dkrsb-1225861182878

Australia Introduces Super Profits Tax on Mining | Vanadium ...

25 May 2010 ... has proposed a Resource Super Profits Tax (RSPT) that will tax profits from ... By Desmond McMahon– Exclusive to Vanadium Investing News ...

vanadiuminvestingnews.com/.../australia-introduces-super-profits-tax-on-mining - CachedFactbox: the new mining tax - ABC News (Australian Broadcasting ...

25 May 2010 ... Super Profits Tax (RSPT) aims to reform taxation in the mining ... The ABC News Online Investigative Unit encourages whistleblowers, ...

www.abc.net.au/news/stories/2010/05/25/2908894.htm - CachedPeter Martin: Five easy pieces - the Mining Super Profits Tax

25 May 2010 ... "Without the RSPT mining companies and their largely foreign shareholders would ... It's not a tax, it applies to more than super profits, ... This is worth reading · This will make you want to watch the news -- Soooo. ...

petermartin.blogspot.com/.../five-easy-pieces-mining-super-profits.html -

CachedWayne Swan on Budget; Resource Super Profits Tax

Breaking News: Wayne Swan on Budget; Resource Super Profits Tax » Today's .... The third is that the RSPT applies to less of a mine's income than company ...

australia.to/.../index.php?...super-profits-tax...news... - CachedRudd's planned super profits tax gain economists' support ...

25 May 2010 ... The proposed 40 per cent resources super profits tax (RSPT) ... Rudd's planned super profits tax gain economists' support. Latest News in Economy ... that the RSPT is a more efficient way to tax the mining sector without ...

www.ibtimes.com/.../rspt-super-profits-tax-resources-super-profits-tax-allan-fels.htm - CachedRudd defends use of old tax data | Mining super profits tax | RSPT

25 May 2010 ... 25 May The federal government's super-profits tax will result in Chinese mining companies gobbling up Australian assets, Fortescue Metals ...

www.brisbanetimes.com.au/.../rudd-defends-use-of-old-tax-data-20100525-wa8s.htmlMining super profits tax: an economic perspective | University ...

1 Jun 2010 ... The RSPT is a 40% tax on all profits made above the 6% rate of ... Mining companies claim that defining “super-profits” at the 6% rate of ...

www.unisaustralia.com/.../mining-super-profits-tax-an-economic-perspective/ - 16 hours agoGet more results from the past 24 hours

The Resource Super Profits Tax | RSPT | mining | Federal Budget

11 May 2010 ... The Resource Super Profits Tax is a 40 per cent tax on mining profits, ... of 6 per cent from their existing earnings - called the RSPT allowance. .... they've lost the war · Downer shares plunge 27% on costs news ...

www.smh.com.au/.../the-resource-super-profits-tax--what-is-it-20100511-usnu.html

Mining super profits tax won't hit cost of living, says Treasury ...

Mining super profits tax won't hit cost of living, says Treasury boss Ken Henry. By staff writers; From: news.com.au; May 28, 2010 8:26AM ... And while mining executives have warned the RSPT would increase sovereign risk, ...

www.news.com.au/...rudd...mining-tax.../story-e6frfm1i-1225871830341Resource Super

Profits Tax 'to share mining wealth' | News.com.au

2 May 2010 ... Mining. The Federal Government has devised a Resource Super Profits Tax (RSPT) to give the public a share of resource profits more ...

www.news.com.au/...super-profits-tax...mining.../story-fn5dkrsb-1225861182878

Australia Introduces Super Profits Tax on Mining | Vanadium ...

25 May 2010 ... has proposed a Resource Super Profits Tax (RSPT) that will tax profits from ... By Desmond McMahon– Exclusive to Vanadium Investing News ...

vanadiuminvestingnews.com/.../australia-introduces-super-profits-tax-on-mining - CachedFactbox: the new mining tax - ABC News (Australian Broadcasting ...

25 May 2010 ... Super Profits Tax (RSPT) aims to reform taxation in the mining ... The ABC News Online Investigative Unit encourages whistleblowers, ...

www.abc.net.au/news/stories/2010/05/25/2908894.htm - CachedPeter Martin: Five easy pieces - the Mining Super Profits Tax

25 May 2010 ... "Without the RSPT mining companies and their largely foreign shareholders would ... It's not a tax, it applies to more than super profits, ... This is worth reading · This will make you want to watch the news -- Soooo. ...

petermartin.blogspot.com/.../five-easy-pieces-mining-super-profits.html -

CachedWayne Swan on Budget; Resource Super Profits Tax

Breaking News: Wayne Swan on Budget; Resource Super Profits Tax » Today's .... The third is that the RSPT applies to less of a mine's income than company ...

australia.to/.../index.php?...super-profits-tax...news... - CachedRudd's planned super profits tax gain economists' support ...

25 May 2010 ... The proposed 40 per cent resources super profits tax (RSPT) ... Rudd's planned super profits tax gain economists' support. Latest News in Economy ... that the RSPT is a more efficient way to tax the mining sector without ...

www.ibtimes.com/.../rspt-super-profits-tax-resources-super-profits-tax-allan-fels.htm - CachedRudd defends use of old tax data | Mining super profits tax | RSPT

25 May 2010 ... 25 May The federal government's super-profits tax will result in Chinese mining companies gobbling up Australian assets, Fortescue Metals ...

www.brisbanetimes.com.au/.../rudd-defends-use-of-old-tax-data-20100525-wa8s.htmlMining super profits tax: an economic perspective | University ...

1 Jun 2010 ... The RSPT is a 40% tax on all profits made above the 6% rate of ... Mining companies claim that defining “super-profits” at the 6% rate of ...

www.unisaustralia.com/.../mining-super-profits-tax-an-economic-perspective/ - 16 hours agoGet more results from the past 24 hours

Subscribe to:

Posts (Atom)