Swan's secret surplus recipeStephen Bartholomeusz

Published 1:24 PM, 7 Oct 2010 Last update 10:14 AM, 8 Oct 2010

ref: http://www.businessspectator.com.au/bs.nsf/Article/BHP-Billiton-Rio-Tinto-MRRT-RSPT-swan-xenophon-pd20101007-9Z44C?OpenDocument&src=kgb

--------------------------------------------------------------------------------

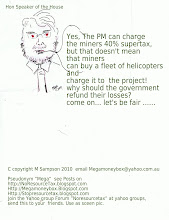

It is unclear why Wayne Swan thinks releasing the commodity price assumptions on which the federal government’s forecasts of the revenue that will be raised by the mineral resource rent tax and expanded petroleum resource rent tax is such a sensitive issue.

Swan has been resisting calls from independent senator Nick Xenophon to release the details of the forecasts and the assumptions under-pinning them, saying that Treasury has never published detailed information about individual commodities. Discussions Treasury had with the big resource companies were confidential and would be damaging to the companies and the national interest if those numbers were released, he said today.

The MRRT, of course, was the substitute for the controversial resource profits super tax that emerged after pre-election negotiations with BHP Billiton, Rio Tinto and Xstrata.

Had it not been for a convenient revision of the commodity forecasts that had been behind the government’s assumptions that the RSPT would raise $12 billion in its first two years, the MRRT would have raised at least $7.5 billion less. Instead it is expected to raise only $1.5 billion less – $10.5 billion versus $12 billion, thanks to a $6 billion boost from the more optimistic assumptions.

The MRRT has a much lower headline tax rate (effectively 22.5 per cent versus 40 per cent) than the RSPT it displaced, a more generous uplift rate, the option of using market value rather than historical cost as the base for the tax calculations and applies only to iron ore and coal projects that generate more than $50 million of profits a year.

At the time the revision was made iron ore prices were actually falling, so the forecasts presumably weren’t based on the market prices at the time but on somewhat longer term forecasts that emerged from the discussions with the miners, as well as "new information" from ABARE and "industry sources."

Treasury has said it has assumed commodity prices will actually start to fall in the later stages of the forward estimates and continue declining in the medium term as the supply-side response to strong iron ore and coal prices starts to impact.

Companies like BHP and Rio are coy about the precise commodity price assumptions they use to plan their capital expenditure programs but have said on a number of occasions that they use the forward curve in the near term – 18 to 24 months – but then revert to long term trend pricing. From Treasury’s description of the impact of its revised forecasts it would appear it has taken a similar approach.

Provided the revised assumptions that enabled the government to ditch the RSPT and replace it with the narrower and less punitive MRRT aren’t wildly out of kilter with the forward curve and/or market consensus for the critical 2012-13 and 2013-14 budget years there would be nothing particularly sensitive about divulging the forecasts, particularly as Treasury has cited several sources for the revised assumptions – the assumptions being used by the individual big miners wouldn’t have to be revealed.

If they were wildly optimistic and completely out of line with market expectations, of course, the government would be severely embarrassed and its claims to fiscal responsibility would be in question.

The problem the government has is that neither the mining industry nor those that analyse it believe the tax will raise $10.5 billion in its first two years. Even the big miners are privately sanguine about its impact.

That means there is a credibility issue over-hanging a key element of the government’s promise to return to budget to surplus in 2012-13 – a key election promise.

Swan, who to his credit has consistently committed to sticking with the framework of the MRRT agreed with the big miners despite the kudos an increase in the tax rate and a broadening of the MRRT’s coverage might gain the government with the Greens and independents, could address that by releasing the broad assumptions that under-pin the MRRT revenue estimates. Unless, of course, he does have something to hide.

Thursday, October 7, 2010

Subscribe to:

Comments (Atom)